The international market’s resurgence in commodity prices, such as fuel oil, rice, wheat, and soybean oil, adds to the pressure on the nation’s import costs.

Starting from this Sunday, the surge in the value of the US dollar is making its presence felt. Consequently, the cost of purchasing dollars for imports has escalated by 50 paisa compared to previous rates. In some instances, the additional expense is even greater due to several banks selling dollars above the established limit. This development is poised to elevate import expenses, consequently driving up product prices.

Moreover, those who engage in foreign currency transactions via cards will now incur an extra one taka in fees. Transactions made through cash, drafts, or telegraphic transfers (TT) will also bear additional charges, leading to heightened consumer spending. Consequently, this will exert upward pressure on overall inflation. Conversely, the appreciation of the dollar will result in the depreciation of the Bangladeshi taka, reducing consumers’ purchasing power. In combination, these factors will exacerbate the hardships faced by individuals with lower and middle incomes.

On Thursday, the Bangladesh Foreign Exchange Association (BAFEDA) and the Association of Bankers Bangladesh (ABB), an organization comprising top executives of commercial banks involved in foreign currency dealings, made the decision to further increase the dollar’s exchange rate.

YOU CAN ALSO READ: SHIFTING TIDES: IS THE US DOLLAR’S REIGN COMING TO AN END?

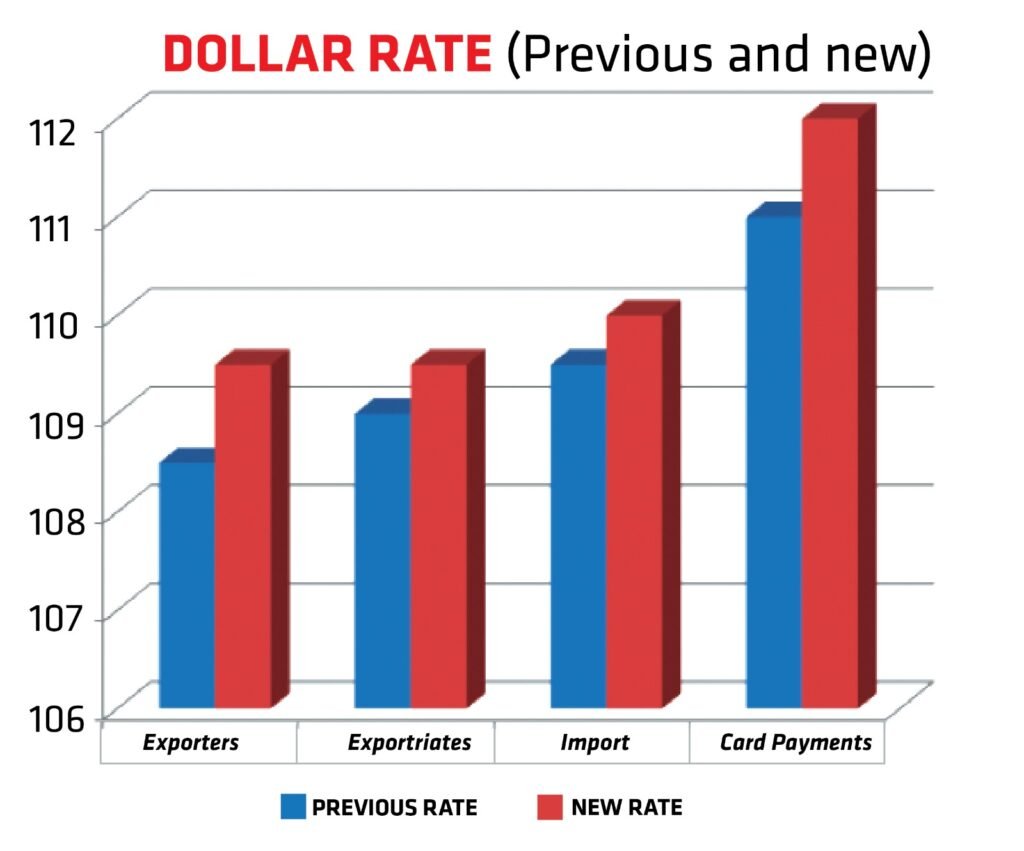

The revised dollar exchange rate

Following the recent decision, exporters will now receive a maximum of 109 taka and 50 paisa per dollar starting from today, up from the previous rate of 108 taka and 50 paisa. This adjustment grants exporters an additional Tk. Expatriates will also benefit from this change, receiving a maximum of 109 taka and 50 paisa for remittance dollars, compared to the earlier rate of 109 taka, which represents an increase of 50 paisa on every dollar.

Banks will adjust their selling prices accordingly due to the higher purchase costs of dollars. Consequently, the dollar’s import price has risen by 50 paisa, increasing from the previous rate of 109 taka and 50 paisa to 110 taka. For card payments, the new rate is 112 taka per dollar, as opposed to the previous rate of Tk.111 (Figure 01).

To implement these changes, BAFEDA, the organization comprising managing directors of the country’s banks, has issued a circular to the chief executives of commercial banks. BAFEDA has been in charge of controlling the dollar’s price since September of the previous year, and it has been steadily increasing month by month.

The root of this dollar crisis can be traced back to February 24 of the prior year when Russia’s attack on Ukraine caused prices for various products to surge in the international market, subsequently driving up the dollar’s price. This crisis began in March of that year, and its severity has continued to escalate. In August of the same year, the dollar’s price reached 95 taka, marking an increase of 11 taka within a year. Now, it has surged to 110 taka per dollar, indicating a 15 taka increase in just the past year. Over the course of two years, the price has risen by 26 taka per dollar, and during this period, the taka has depreciated by 30 percent against the dollar. In essence, the taka’s value has eroded by 30 taka out of every 100 taka due to the rising dollar prices in just two years.

Current cash dollar rates in banks

Amidst the ongoing severe crisis, the price of cash dollars in commercial banks continues to surge. Presently, the price of cash dollars in banks has escalated to a maximum of 113 taka. Notably, one private bank is now selling cash dollars at this rate, while the majority of other banks are offering them at prices ranging from 111 to 112 taka per dollar. A handful of banks are even selling dollars for as low as 110 taka.

Despite these increased prices, bank customers are still facing challenges in obtaining dollars as per their requirements. Consequently, many individuals are resorting to purchasing dollars from the curb market. Concurrently, demand in the curb market is on the rise, further pushing up its prices. As of last Sunday, every dollar was fetching the highest rate of Tk 118, and it has continued to increase slightly since then.

According to reliable sources, Meghna Bank is currently selling cash dollars at a maximum rate of 113 taka, while private sector institutions like Social Islami and Bengal Commercial Bank are offering them at 112 taka. Al Arafah Bank is selling at 111 taka and 75 paisa, Bangladesh Krishi Bank at 111 taka and 60 paisa, and banks like IFIC, City Bank NA, Exim, Global Islami Bank, Mercantile Bank, Madhumati Bank, City Bank, Uttara Bank, NCC Bank, Padma Bank, and Shahjalal Islami Bank are selling dollars at 111 taka and 50 paisa.

Other banks are quoting prices between Tk 110 and Tk 111, with two banks offering dollars below Tk 110. The average selling price for a dollar currently stands at 110 taka and 80 paisa. Among government banks, Sonali, Janata, and Agrani banks are selling at 109 taka and 50 paisa, while Rupali Bank is offering them at 110 taka and 50 paisa.

Meanwhile, in the curb market, dollars are being traded for as high as 120 taka. However, the majority of transactions are taking place within the range of 80 paisa to 118 taka, with an average rate of 117 taka.

Impact of dollar appreciation

Public life

The appreciation of the dollar has ushered in a two-fold challenge. Firstly, there’s been a noticeable surge in commodity prices, while concurrently, the devaluation of local currency has accelerated. This has culminated in a situation where people find it increasingly difficult to align their purchasing power with their needs, resulting in a decline in their overall quality of life. The reduced allocation of funds towards food and healthcare sectors has contributed to a rise in malnutrition-related ailments and a weakening of the population’s immune system. Moreover, there’s been a necessity to cut down on expenses related to education and entertainment, leading to heightened hardship for individuals in the lower and middle-income brackets.

A fresh surge in the dollar’s value is poised to exacerbate the suffering of those in the low and middle-income strata. This is primarily because the need to purchase dollars at higher rates for importing goods will push up the prices of imported products. Consequently, this upward pressure on prices will also extend to other goods and services. Moreover, the depreciation of the local currency will contribute to higher inflation rates. In July, the inflation rate had already reached 9.69 percent, with food products registering the most significant price increases, resulting in a food sector inflation rate of 9.76 percent. Furthermore, inflation has begun to rise more steeply in rural areas compared to urban centers. In July, rural food inflation reached a high of 9.82 percent, marking a recent record. This pattern suggests that in regions with ample food production and supply, food prices are surging the most.

Simultaneously, international market prices for various products, including fuel oil, rice, wheat, and soybean oil, have initiated an upward trajectory. Over the past two months, the price of fuel oil has risen from $80 per barrel to $86. In the same period, the price of rice has increased by 5 percent, while wheat prices have seen a 2 percent uptick. These developments will further escalate the costs associated with imports.

Import

Additionally, prices of various commodities, including fuel oil, rice, wheat, and soybean oil, have once again begun to climb in the global market. Over the past two months, the price of fuel oil surged from $80 per barrel to $86, marking a notable increase. During the same two-month period, the price of rice witnessed a 5 percent upswing, while wheat prices rose by 2 percent. These developments are poised to elevate the expenses associated with importing these goods, consequently amplifying the challenges of managing import costs.

While the central bank is making efforts to alleviate pressure on the dollar by limiting imports, the concurrent rise in global prices will inevitably inflate the overall import expenditures. This, in turn, will exert additional strain on the dollar’s stability, potentially leading to a reduction in foreign exchange reserves. Consequently, there looms a risk of further appreciation of the dollar’s value.

Reserve

There is an impending need to settle debts exceeding $1 billion within the Asian Clearing Union (ACU) for the months of July and August by Thursday. This settlement will, unfortunately, lead to a further reduction in our foreign reserves. Presently, our net reserves stand at $2,307 million, and with this upcoming settlement, they may decline to $2,000 million. Notably, our net reserves had already dwindled to $2,300 million back in April. In June, they briefly surpassed $2,400 million following ACU debt repayment, only to drop back to $2,300 million after this transaction. Since then, the downward trend in reserves has persisted, potentially culminating in a further decrease to $2,000 million by Thursday.

Furthermore, one of the conditions set forth by the International Monetary Fund (IMF) is the establishment of a uniform exchange rate for the dollar across all official channels. In response, banks have taken strides toward fulfilling this requirement by aligning the dollar price for export earnings and remittances. Previously, the dollar value of remittances exceeded that of exports, but this move aims to create a uniform dollar rate in other sectors as well.

Conclusion

The recent surge in the US dollar’s value has triggered a chain reaction that is deeply impacting various facets of the nation’s economy and the lives of its citizens. From rising import costs and inflationary pressures to the daily struggles of people in the lower and middle-income brackets, the consequences of this dollar appreciation are widespread.

As the value of the taka continues to depreciate, the cost of living is steadily increasing, making it challenging for individuals to meet their basic needs. Food and healthcare sectors are particularly affected, with a surge in malnutrition-related diseases and a weakened immune system among the population. The ripple effect extends to education and entertainment expenses, which are being curtailed, intensifying the hardships faced by many.

Additionally, the recent adjustments in the dollar exchange rate are further exacerbating the situation. Exporters and expatriates may benefit, but the overall impact on import costs and inflation is significant. The rise in import expenses due to higher dollar purchase costs is expected to push product prices higher across the board, worsening inflation rates. Notably, food inflation is hitting rural areas the hardest, signaling a concerning trend in regions where food production and supply should ideally keep prices in check.

The international market’s resurgence in commodity prices, such as fuel oil, rice, wheat, and soybean oil, adds to the pressure on the nation’s import costs. While the central bank is attempting to manage these challenges by curbing imports, the simultaneous increase in global prices creates a precarious balancing act. Foreign exchange reserves are at risk of further depletion, which, in turn, could lead to further appreciation of the dollar’s value.

In conclusion, the rising dollar is a formidable force that demands swift and strategic actions to mitigate its adverse effects. The nation faces a critical period where prudent economic management and policy decisions are imperative to safeguard the well-being of its citizens and the stability of its economy.