As the dominance of the US dollar faces a gradual erosion, the global economy braces for a transformative shift. Emerging market economies, the rise of digital currencies, and escalating geopolitical tensions contribute to the chipping away at the dollar’s supremacy, calling for cooperation, innovation, and adaptability in navigating the evolving financial landscape, Writes SM TANJIL-UL-HAQUE

The United States dollar (USD) has long reigned supreme as the dominant global currency, serving as the backbone of international trade and finance.

YOU CAN ALSO READ: BANGLADESH’S NON-ACCESSION TO THE BRICS: POLITICAL SHIFT OR ECONOMIC PRIORITY?

However, the once unassailable position of the US dollar is facing an erosion that raises questions about its future as the world’s preferred currency. A convergence of factors, including the rise of emerging market economies, the ascent of digital currencies, and growing geopolitical tensions, has set the stage for a potential shift in the global financial landscape.

EMERGING MARKET ECONOMIES CHALLENGING THE STATUS QUO

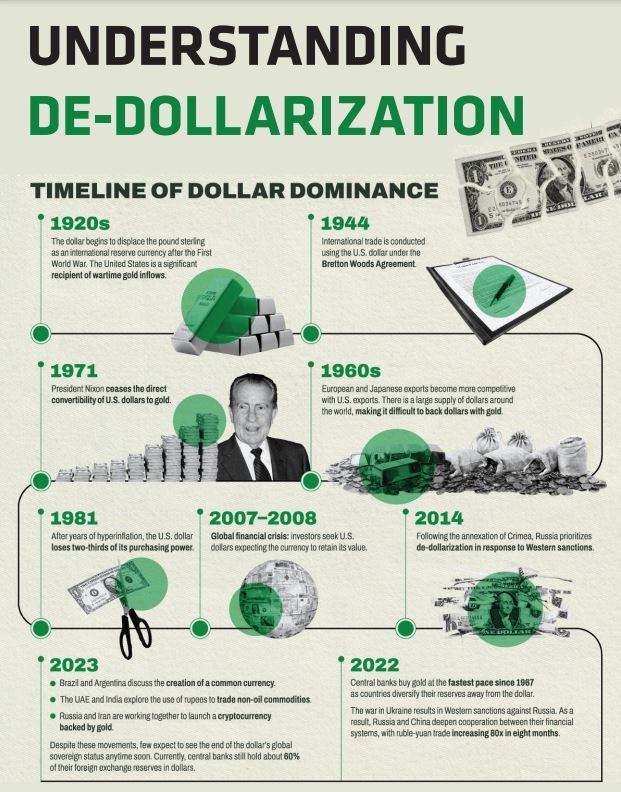

The surge of emerging market economies has appeared as a primary catalyst in the erosion of the US dollar’s dominance. Nations such as China, India, Brazil, and Russia have experienced rapid economic growth, fuelling their ascent as key players in international trade and finance. These nations are increasingly challenging the historical dominance of the US dollar, reshaping the global economic order. China, in particular, has actively promoted the use of its currency, the renminbi, in international transactions. In 2016, the inclusion of the renminbi in the International Monetary Fund’s basket of currencies used for valuing special drawing rights underscored China’s rising influence and its aspirations to challenge the supremacy of the US dollar.

CAN A BRICS-ISSUED CURRENCY INTERRUPT DOLLAR DOMINANCE?

As the discussion surrounding de-dollarisation gains momentum, the prospect of a BRICS-issued currency emerges as a potential game-changer. While previous attempts to challenge the dollar have fallen short, a currency backed by Brazil, Russia, India, China, and South Africa could pose a legitimate threat to the dollar’s supremacy. Unlike other proposed alternatives, such as a digital yuan, a BRICS-issued currency has the potential to dislodge or at least shake the dollar’s position as the reserve currency of its member nations.

If the BRICS were to exclusively use this hypothetical currency, known as the ‘bric,’ for international trade, it would remove the obstacles that currently hinder their efforts to escape dollar hegemony. With the BRICS collectively running a trade surplus and possessing a level of economic self-sufficiency that surpasses existing currency unions, the idea of a BRICS currency gaining traction becomes increasingly realistic. Additionally, the economic influence of BRICS members within their respective regions could attract other countries worldwide to engage in bric-denominated transactions, further bolstering its potential as a viable alternative to the dollar.

GEOPOLITICAL TENSIONS: A CONTRIBUTING FACTOR?

The escalating geopolitical tensions between the United States and other major economies, such as China and Russia, further undermine the position of the US dollar as a global currency. Leveraging its role as the issuer of the world’s reserve currency, the US has employed economic sanctions to restrict countries that diverge from its political or economic agenda.

Russia, Iran, and Venezuela are among the nations subjected to such sanctions, curtailing their access to the global financial system. In response to these actions, countries have sought alternative payment systems and reserve currencies to reduce their vulnerability.

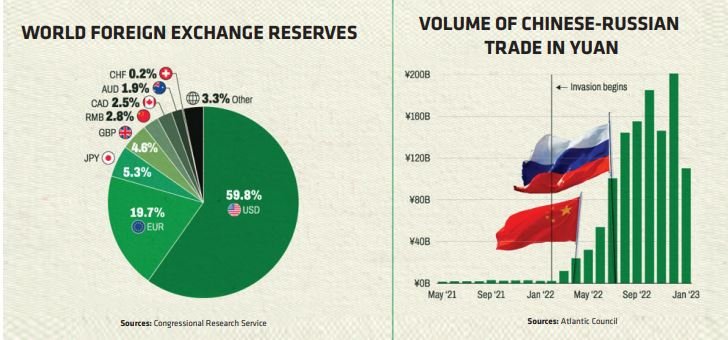

Russia and China, for instance, have been actively reducing their dependence on the US dollar in bilateral trade by employing their national currencies. Concurrently, they promote their currencies in international trade and finance, aiming to diminish the influence of the US dollar.

THE RISE OF DIGITAL CURRENCIES

The growing utilisation of digital currencies further contributes to the erosion of the US dollar’s position as a global currency. Decentralised and independent of traditional financial institutions, digital currencies like Bitcoin and Ethereum offer secure, fast, and cost-effective transactions, presenting an enticing alternative to traditional currencies. While digital currencies have not yet achieved widespread adoption in international trade and finance, their popularity is steadily increasing among individuals and businesses.

Remarkably, some countries, including El Salvador, have gone as far as adopting Bitcoin as legal tender. Others, like China, are actively developing their digital currencies. As these digital currencies gain mainstream acceptance, they pose a potential challenge to the dominance of the US dollar and other conventional currencies in international transactions.

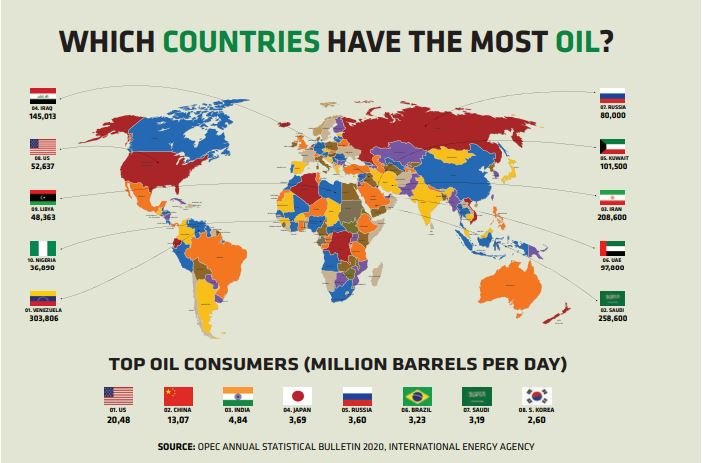

BREAKING THE PETRODOLLAR CHAIN

In recent years, the foundation of the petrodollar, which has long supported the dominance of the US dollar as a global currency re- serve, is showing signs of vulnerability. Saudi Arabia, a key player in the petrodollar system, has started to hedge and diversify its security by normalising relations with neighbouring countries. Additionally, China, a major buyer of Saudi oil exports, has recently agreed to settle a portion of its oil trade in Yuan, signalling a desire to reduce its reliance on the dollar. This gradual shift away from the petrodollar poses a risk to its stability and paves the way for more countries like Russia and India to seek alternative currencies for trade, such as the Ruble and Rupee.

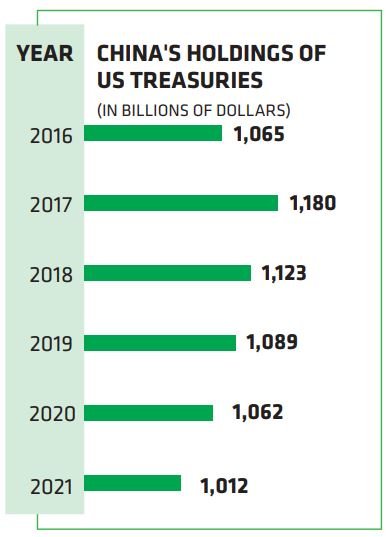

As a result, the dollar’s role as a global reserve currency could be further eroded, impacting countries like Bangladesh, which heavily depend on the stability of the US dollar in international trade. For instance, China, one of the world’s largest economies, has been steadily reducing its holdings of US treasuries. From holding approximately $1 trillion in US treasuries, China has decreased its holdings to around $859 billion, the lowest level in recent years.

This reduction highlights China’s efforts to diversify its foreign reserves and move away from the USD. Similar trends can be observed in other countries as well, as they seek to decrease their exposure to the risks associated with the petrodollar system.

PARADIGM SHIFT TOWARDS BILATERAL CURRENCY SWAPS

Another significant development in the move away from the US dollar as a global reserve currency is the increasing adoption of bilateral currency swaps for trade between countries. This trend aims to reduce dependence on the dollar and mitigate the risks associated with its weaponisation and sanctions. Countries like India have entered into agreements with multiple nations, including Germany, Kenya, Sri Lanka, Singapore, and the UK, to trade in their respective currencies, bypassing the need for dollars. Brazil, a member of the BRICS grouping, has also reached an agreement with China to trade in yuan, further demonstrating the diversification of currency usage.

These bilateral currency swaps are gaining traction within regional trade blocs, where countries with integrated trading relationships are seeking to reduce their dollar dependency. In fact, as of 2023, China has signed agreements with 41 countries for the use of yuan in clearing bilateral trade. Notably, 18 countries have agreed to trade in Indian rupees, showcasing the growing acceptance of non-dollar currencies in international transactions. Moreover, the Belt and Road Initiative (BRI), launched by China in 2013, has seen formal affiliations with 149 countries, emphasizing the global shift towards alternative trading arrangements beyond the dollar.

GEOPOLITICAL IMPACT AND MITIGATING THE RISKS

The erosion of the US dollar’s position holds significant geopolitical implications. The dominance of the US dollar has granted the United States significant influence over the global financial system, allowing it to impose economic sanctions on disagreeable countries. If the erosion continues, the US may experience a loss of economic and geopolitical power.

To mitigate the risks associated with the diminishing position of the US dollar, many countries are diversifying their reserves and reducing reliance on the USD. For example, Russia and China are increasing their holdings of gold and exploring alternative currencies such as the euro and the yen. Additionally, infrastructure investments, like the BRI, aim to foster increased trade and investment across Asia, Europe, and Africa while reducing dependence on the US-dominated global financial system.

These measures reflect the proactive steps taken by countries to address the risks associated with the shifting global financial landscape. By adapting to the changing dynamics and seeking alternatives, countries are positioning themselves to navigate the potential consequences of a weakened US dollar. The geopolitical implications of these shifts are yet to be fully realised, but they underscore the efforts made by nations to ensure stability and resilience in the face of evolving global currency dynamics.

IMPLICATIONS FOR THE GLOBAL ECONOMY

The erosion of the US dollar’s position as a global currency carries substantial implications for the global economy. While the US dollar’s dominance has provided certain benefits, such as higher living standards for US citizens, the weakening position of the dollar presents challenges for maintaining current economic policies. Higher borrowing costs and the potential need to reduce trade deficits may impact the standard of living for US citizens.

However, the decline of one country’s dominance in the global financial system also opens up opportunities for positive change. It can foster a more balanced and inclusive world by encouraging greater cooperation among nations, promoting the development of alternative financial frameworks, and fostering a multipolar currency landscape. This shift has the potential to benefit global economic stability and resilience by reducing reliance on a single dominant currency and creating a more diverse and robust international financial system.

WHAT SHOULD BE BANGLADESH’S APPROACH?

As the world undergoes a rapid de-dollarisation process amidst geopolitical tensions and economic challenges, Bangladesh finds itself in a position where it needs to revaluate its currency dependence strategy. With the US dollar’s hegemony in question and the risks associated with its weaponisation, exploring alternatives becomes imperative. Historically, the dollar has dominated global trade and held a significant share of foreign exchange reserves. However, recent trends indicate a decline in its dominance, with countries like China, Russia, and Iran taking steps to limit their reliance on the dollar and establish alternative payment systems.

In this evolving multipolar world, Bangladesh faces inflationary pressures and dwindling foreign exchange reserves. Recognising the need to adapt, the country has shown interest in conducting business in local currencies and diversifying its forex reserves. Recent agreements between Bangladesh, Russia, and China to transact in yuan showcase a willingness to embrace alternative currencies. Additionally, joining the list of countries trading in Indian rupees highlights the country’s exploration of diversified currency options.

Nevertheless, while the shift away from the dollar presents opportunities, careful consideration of long-term benefits and sustainability is essential for Bangladesh’s growing economy.

THE FUTURE OF DOLLAR’S REIGN

While the erosion of the US dollar’s dominance will not happen overnight, it is an undeniable trend that signals a shift in the global currency landscape. The implications encompass higher borrowing costs for the US, a potentially fragmented and unstable global financial system, and a shift in geopolitical power dynamics. To address the risks of depending on a particular currency, countries will need to diversify their reserves, invest in alternative payment systems, and reduce their dependence on the US-dominated global financial framework.

The shifting tides may ultimately usher in a new era in the global financial landscape. But, the future of the US dollar’s reign as the dominant global currency hangs in the balance as shifting tides reshape the international financial landscape. While its position remains formidable, the erosion of its supremacy cannot be ignored. The rise of emerging market economies, the disruptive potential of digital currencies, and escalating geopolitical tensions all contribute to the chipping away at the US dollar’s hegemony. The world braces for a future where the dominance of the US dollar is shared or even relinquished to other currencies.

The global financial ecosystem is in a state of flux, and adaptation will be key to weathering the shifting tides. In this new era, cooperation, innovation, and open dialogue will be crucial. Governments, financial institutions, and market participants must work together to navigate the challenges and seize the opportunities presented by the evolving global currency landscape. As the US dollar’s reign faces potential twilight, a new chapter in the history of global finance begins- a chapter that promises both uncertainty and the potential for a more balanced and inclusive financial world