Amidst changing global dynamics, savvy investors who grasp China’s economic landscape can seize diverse opportunities in emerging markets, capitalizing on the evolving economic scene

The landscape of emerging markets, characterized by the ascent of developing nations that are assuming a progressively larger role in the global economy, presents enticing opportunities for sustained growth. Among the array of emerging market countries, China stands as an undeniable giant, boasting not only its magnitude but also a recent history of unparalleled economic expansion.

Moreover, China’s transformative influence on the global economic stage stands out as one of the most significant narratives of the past five decades. Emerging from a state of relative isolation in the late 1970s, China has metamorphosed from a predominantly rural nation into a crucial market with a thriving economy and an increasingly urbanized middle class.

You can also read: Will China’s Yuan Slip Further to Aid Economic Recovery?

However, the current trajectory of China’s economic journey is not devoid of challenges. While it remains a heavyweight in the global economic arena, China faces complexities in its path. The nation’s economic growth, while ongoing, has encountered a deceleration, partially due to stringent COVID-19 containment measures that mandated temporary lockdowns in key urban centers. Furthermore, the evolving dynamic between the world’s two largest economies, the United States and China, is marked by discernible tensions.

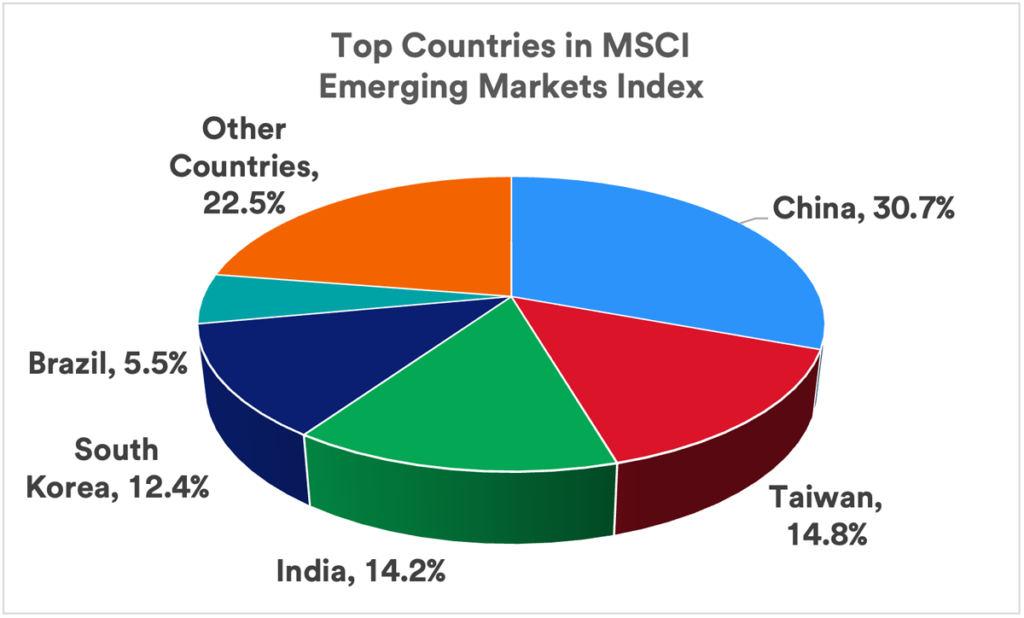

This unexpected turn of economic challenges contrasts with China’s recent history of remarkable growth. China’s role in the global capital market has solidified, with its stock market alone accounting for nearly a third of the MSCI emerging market index.

China’s global influence

Rob Howarth, senior director of investment strategy at US Bank Wealth Management, highlights the significant presence of China’s influence. He emphasizes that any investor engaging in a broad emerging market index is likely to hold a substantial stake in Chinese equities. This influence extends to other major players in the global emerging equity markets, including Taiwan and South Korea, which share significant trade partnerships with China.

The dynamic shift in China’s population landscape

The metamorphosis of China’s demographic landscape, from a modest standard of living in an agrarian society to its present-day marvel, is a remarkable journey. The late 1970s marked a pivotal moment as China’s economy underwent a sweeping transformation, with rapid growth becoming an integral narrative of its economic saga. While it is still acknowledged as an emerging market, China’s economy has undeniably progressed.

“The tale of China’s middle-class growth was a defining narrative for many years,” Rob Howarth noted, “but the narrative has shifted.” In the past decade, China’s economy, as gauged by GDP, frequently expanded by over 10% annually, leading to an unprecedented expansion of its middle class.

According to Howarth, two pivotal factors have shaped this trajectory: China’s burgeoning middle class and the emergence of demographic challenges. In 1980, China introduced a one-child family policy, a measure that endured until 2016. Despite the policy’s conclusion, the deliberate limitation of the younger generation’s population could potentially usher in an aging demographic and trigger additional economic complexities.

This predicament includes a reduced workforce to meet the needs of an aging populace, potentially resulting in an overall population decline that could impede future economic advancement. Intriguingly, by 2023, India is projected to surpass China as the world’s most populous country. This marks a shift in the global demographic narrative, as China had held this distinction since the United Nations’ inaugural recording of world population statistics in 1950.

Trade strains and evolving dynamics

Following a prolonged period of relatively open trade between the United States and China, the current landscape is marked by heightened barriers and complexities. The American public had grown accustomed to China’s robust manufacturing capabilities, and US companies had fostered significant imports from China. In 2018, under the leadership of President Donald Trump, the implementation of new tariffs and various restrictions reshaped trade dynamics, most of which endure during President Joe Biden’s tenure.

In a pivotal move during August 2023, President Biden enacted an executive order aimed at curtailing US investment in China, particularly focusing on sectors such as semiconductors, microelectronics, quantum computing, and specific artificial intelligence capabilities. This addition to the prevailing tension within trade relations between the two countries carries potential economic ramifications.

“The multiplication of trade restrictions often generates friction within economic growth projections,” remarked Tom Heinlein, national investment strategist at US Bank Asset Management.

Geopolitical disparities between the United States and China have heightened in recent years, further adding to the intricate trade landscape. An illustrative instance is the burgeoning relationship between Chinese President Xi Jinping and Russian President Vladimir Putin, which persisted even after Russia’s incursion into Ukraine. Notably, Rob Howarth observed that this close rapport hasn’t translated into China’s provision of military assistance to Russia.

While the potential for deepening tensions between China and Western nations, including the United States, looms, there have been encouraging signs of a thaw in US-China tensions. A meeting between US Secretary of State Anthony Blinken and Chinese President Xi serves as a testament to this developing trend.

“Despite the ongoing trade tensions, economic activity often aligns more with the contours of the economic cycle than with trade policy,” Howarth explained. He went on to emphasize, “However, these policies do potentially cast a shadow on the path ahead. Reduced investment from the United States may lead to diminished trade activity.” Nonetheless, it’s worth noting that the trade equation between China and the United States is notably skewed, with Chinese exports to the United States dominating the landscape. In contrast, Howarth pointed out that Japan and Europe maintain more robust export relations with China than with the United States.

China’s economic reemergence and trajectory of growth

Amid the global battle against COVID-19, China emerged as a notable exception, successfully containing the reported death toll within its borders. However, this achievement came at a cost as the nation enacted prolonged shutdowns of major cities, inflicting significant damage upon its economy. By the close of 2022, China phased out its “Zero Covid Policy,” fostering optimism for the resurgence of its rapid economic growth. Unfortunately, the outcomes achieved thus far have been underwhelming.

Rob Howarth notes that the path to recovery unfolded at a deliberate pace. China’s GDP for the first quarter of 2023 exhibited an annualized growth rate of 2.2%, only to taper down to 0.8% in the subsequent quarter. In contrast, the United States deployed substantial stimulus measures, positioning individuals and businesses for robust spending once the economy reopened. Remarkably, China lacked a similar comprehensive plan.

Distinguishing itself from the United States, China’s economy has historically been less consumer-driven. The nation’s focus often gravitates towards job creation through strategic investments such as in housing and high-speed rail projects. The underlying hope is that a bolstered workforce will drive consumer spending, uplifting the economy. However, Tom Heinlin highlighted that a slowdown in the real estate sector has cast a shadow on China’s overall economic growth trajectory. Drawing a parallel, Heinlin likened China’s real estate market to the role the stock market plays in the United States—its fluctuations potentially impacting consumer confidence in various spending domains.

Recent indicators suggest a discernible shift in China’s GDP growth rate, implying a deceleration compared to the pace witnessed over the preceding two decades.

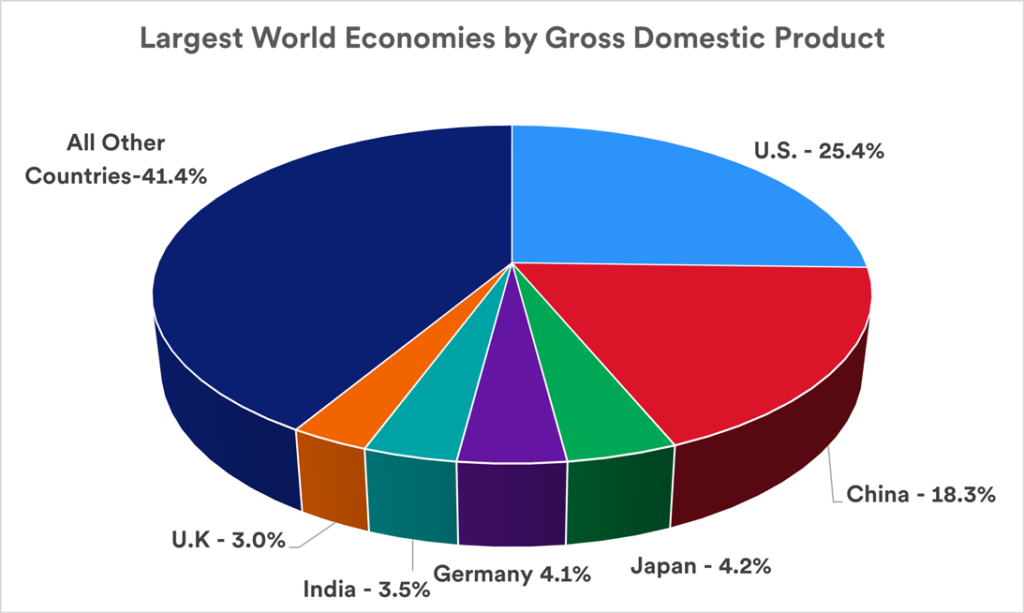

China’s Stance as the Globe’s Second-Largest Economy, as Quantified by GDP, Persists as a Key Role Player on the Global Economic Platform. As China’s Manufacturing Resumes Regular Operations, a Consistent Stream of Manufactured Goods Aids in Resolving Ongoing Global Supply Chain Issues. Concurrently, China’s Trade Engagements with Proximate Nations such as Taiwan, Japan, Korea, and Vietnam are Poised to Gain Momentum in Tandem with China’s Economic Reinvigoration.

Exploring the potential of international stock investments

The integration of international stocks can significantly enhance the diversification of investment portfolios. Rob Howarth highlights that the current juncture presents a favorable window for US investors to contemplate delving into international equities. “One advantageous factor is the weakening of the dollar. A depreciation of the dollar vis-à-vis other currencies can provide a boost for US investors with holdings in foreign markets.”

Howarth attributes the dollar’s frailty as a contributing factor to the nearing conclusion of the Federal Reserve’s ongoing interest rate hike cycle. Another notable catalyst is the amelioration in investment fundamentals across numerous foreign markets. He asserts that a multitude of emerging market stocks, China included, are presently trading at more modest valuation levels. Emerging market equities encountered considerable challenges in 2022, trailing the performance of globally developed markets over the five-year span culminating on July 31, 2023.

Tom Heinlin perceives China’s present relative economic vulnerability as emblematic of the broader global landscape. “While the US and Japanese economies display resilience, Europe and China confront more formidable headwinds.” Heinlin advocates for investors to weigh these elements when assessing prospects within international markets.

Howarth underscores the rationale for contemplating the allocation of a portion of equity assets towards non-US stocks, inclusive of emerging market stocks. He recommends steering clear of direct investments in Chinese equities and instead favors emerging market funds that mirror a comprehensive index of stocks. “The emerging markets index presents significant exposure to Chinese stocks, constituting nearly one-third of the MSCI emerging markets index,” notes Howarth. “However, it also furnishes exposure to diverse markets that serve as safeguards against potential risks associated with exclusive investment in the Chinese market.”

Cognizant of concerns surrounding the precision of accounting practices for publicly traded Chinese enterprises, Howarth points to additional factors warranting vigilance. These encompass ongoing tensions between the United States and China, alongside the possibility of direct intervention by the Chinese government that could impinge upon specific companies or sectors. Howarth advises diversifying emerging market exposure through a strategic approach like Benchmark, which could serve as an optimal conduit for US investors seeking entry into the Chinese market.

Any recalibration of your investment strategy should align with your goals, time horizon, and risk tolerance. Engaging with your US bank wealth professional for a comprehensive review of your current financial blueprint can illuminate opportunities for incorporating emerging market stocks—enriched by exposure to China—within a broader and well-balanced portfolio.

In conclusion

China continues to script its narrative amidst a backdrop of shifting global dynamics, investors who approach its economic landscape with insight and strategic acumen stand poised to capitalize on the diverse array of opportunities that emerging markets, particularly China, present in this ever-evolving economic panorama.

(This analysis is based on The MSCI Emerging Markets Index)