As the Universal Pension Scheme takes effect, it brings with it the promise of a brighter and more secure future and financial security for the elderly citizens of the nation.

The Bangladesh government is embarking on a significant milestone by introducing the Universal Pension Scheme, an initiative designed to provide a sustainable and organized social safety net for the country’s senior citizens. With an aging population and a projected increase in the number of citizens over the age of 60, this program aims to address the growing need for financial security among the elderly and those in the informal economy.

You can also read: HSBC Envisions Bangladesh Stocks on Par with India and Vietnam

Prime Minister Sheikh Hasina inaugurated the Universal Pension Scheme from Ganabhaban Today at 10:00 am. The Universal Pension Scheme, launched recently, has its roots in the past as the scheme was part of prime minister Sheikh Hasina’s previous election manifesto. The Universal Pension Management Act of 2023 was approved on January 31, resulting in the formation of the National Pension Authority on February 12. The specific instructions were issued on August 13.

A multifaceted approach with a shared goal

Any Bangladeshi citizen aged over 18 can take up this scheme at home and abroad. The Universal Pension Scheme encompasses four distinct schemes, each tailored to cater to different segments of the population. These schemes are-

- Pragati,

- Surokkha,

- Samata, and

- Prabashi

The Pragati scheme targets private sector employees, Surokkha focuses on workers in the informal sector (Rickshaw pullers, workers, potter, smiths, fishermen, weavers and self-employed persons), Samata addresses the needs of those with low incomes, and Prabashi caters to expatriate Bangladeshis.

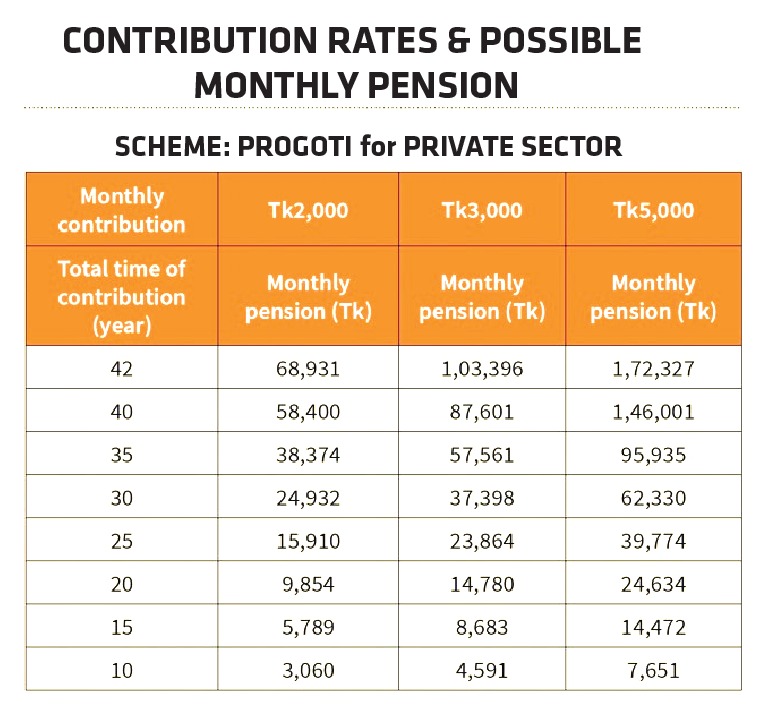

Under the Pragati scheme, private sector employees can contribute monthly installments of Tk2,000, Tk3,000, or Tk5,000, with 50% of the installment covered by the employees and the rest by the companies. Depending on the contribution, individuals can receive pensions ranging from Tk68,931 to Tk1,72,327 per month after the age of 60.

The Surokkha scheme caters to self-employed and informal sector workers, allowing contributions of Tk1,000, Tk2,000, Tk3,000, or Tk5,000 per month. Those who continue the scheme after providing Tk1,000 per month will receive Tk34,465 as a monthly pension after 60 years. Similarly, contributors providing Tk2,000 per month can withdraw Tk68,931 per month after 60 years.

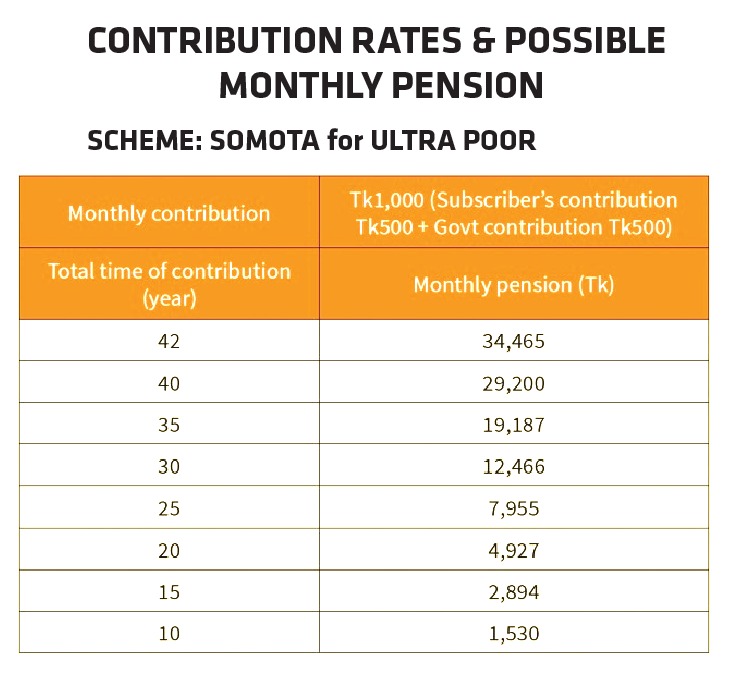

The Samata scheme aims to uplift the ultra-poor, allowing them to contribute Tk1,000 per month while the government covers the remaining Tk500. This scheme offers a monthly pension of Tk34,465 for contributors aged 18 and above, and Tk1,530 per month for those over 50 who contribute for a minimum of ten years.

Lastly, the Prabashi scheme targets migrant workers with monthly contributions of Tk5,000, Tk7,500, or Tk10,000. Depending on the contribution, individuals can receive pensions ranging from Tk1,72,327 to Tk3,44,655 per month after 60 years. After joining the public pension system from abroad, they can pay the contribution in local currency or change the scheme if he returns to the country. The government will pay the pension in local currency to the pensioners of the expatriates on completion of their scheme.

Inside the Universal Pension Scheme: Registration, rules and regulations

Signing up for the Universal Pension Scheme is quite simple. Citizens over the age of 18 can register online using their National Identity Cards (NID) or, for expatriates, their passports. The registration procedure entails selecting the desired scheme, providing personal information, and deciding on a monthly, quarterly, or yearly payment schedule.

The government has established a distinct website for the pension scheme, www.upension.gov.bd, which says “Join the universal pension scheme, ensure you financial security.” Registration is also available for expatriates through the app from abroad.

The contributor will receive 12.31 times the amount paid in monthly, quarterly, or annual installments, depending on the scheme. In addition, failure to deposit the contribution within one month of the due date following enrollment in any scheme will incur a 1% per day penalty. If a pension contributor misses three consecutive payments, his account will be suspended. The account will not be reactivated until all outstanding payments have been made.

The Public Pension Authority can label an applicant as “Insolvent Contributor” if he is permanently or temporarily, partially or completely unemployed and unable to work due to a physical or mental disability. In this situation, the nominee or successor of the insolvent contributor can maintain the scheme by depositing the contribution, and can withdraw the pension at the conclusion of the scheme period.

However, 13.8 million individuals are excluded from the social safety net program; they all receive cash assistance. To be eligible for the pension plan, one must be a recipient of the social safety net. Otherwise, they are ineligible for inclusion in this scheme. Similarly, government employees are unable to participate in this program at this time.

Article 4(3) of the recently issued guidelines for the Universal Pension Scheme allows individuals covered by the social safety net to participate. At age 60, one will begin receiving pension benefits. If a person dies before the age of 75, his/her beneficiary will receive the monthly benefit until the age of the actual recipient reaches 75. If an individual pass away within the first 10 years of a pension plan, his or her nominee will receive the deposited funds with interest.

The need of Universal Pension Scheme: A catalyst for financial security

According to data from the Ministry of Finance’s Finance Division, the population of individuals aged 60 and older is projected to increase from 12 million in 2020 to 31 million in 2041. This transition in the population has prompted the government to take proactive steps to ensure the well-being of its senior citizens. The implementation of the Universal Pension Scheme is a measure toward protecting approximately 85 percent of the low-income population and those working in the informal sector.

In addition to providing a pension, the plan treats contributions as investments, thereby facilitating tax deductions. By viewing contributions as investments and allowing individuals to borrow up to 50 percent of their deposits, this initiative not only ensures pension benefits but also provides a safety net for unforeseen expenditures.

In addition, the government intends to improve the accuracy and efficiency of resource allocation by progressively reducing the number of individuals receiving benefits under existing social security programs. The landscape consists of a variety of social safety net programs, with 13.8 million people receiving direct government financial aid and 3.67 million receiving food assistance. In addition to these, numerous other social safety net programs exist. During the current fiscal year, substantial allocations of Tk43,000 billion have been allocated to financial assistance programs, along with nearly Tk17,000 billion for food assistance initiatives. Additionally, substantial funds have been allocated for other programs.

According to Dr. Ahsan H. Mansur, the Director of the Policy Research Institute, this decision indicates a desire to expedite administrative operations by combining various social safety net programs. Currently, the nation administers approximately 150 social safety net programs, and while not all of them may be necessary, consolidating them into a handful of programs is a viable option. However, it is essential to recognize that these programs are funded by the government.

In conclusion, the Universal Pension Scheme represents a proactive approach to addressing the challenges posed by an aging population and the diverse requirements of citizens across various sectors. The scheme has the potential to have a positive impact on the lives of millions of Bangladeshis due to its user-friendly registration process, multiple scheme options, and financial growth potential.