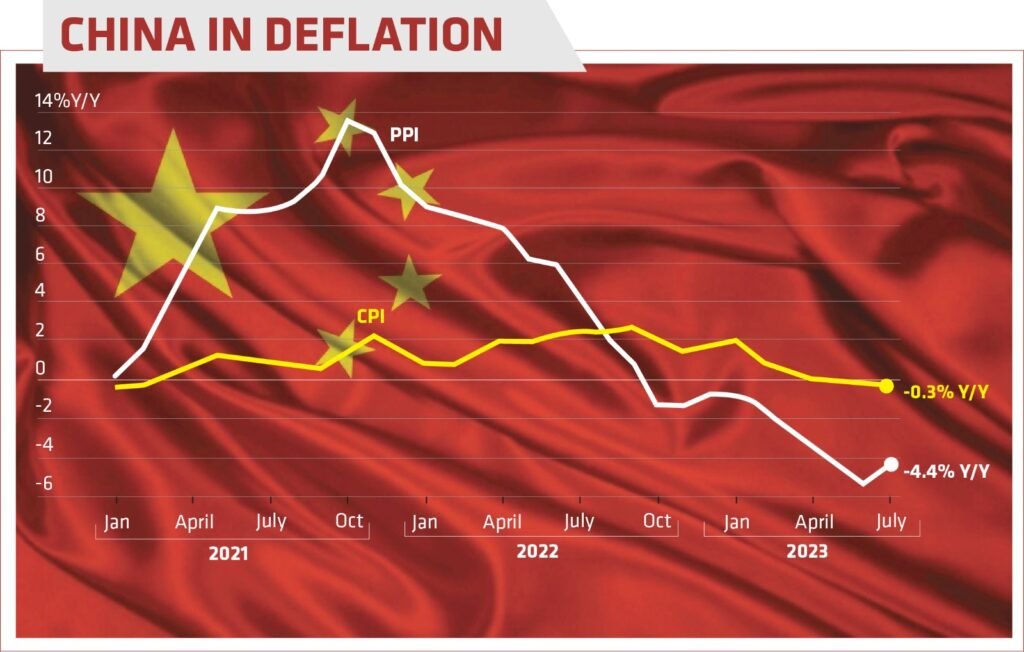

China is now struggling as recently its consumer price index (CPI) dropped by 0.3% from last year and the producer price index (PPI) has dropped to 0.4% for the 10th consecutive time due resulting in increasing deflation

Seems like soon China is about to lose its title of a Global Economic Top-dog as deflation succumbs the national economic stability. This year deflation became heavy on China’s consumer sector while dragging along the stagnating post- pandemic economic recovery.

You can also read: Pakistan Dissolves Parliament Amid Possible Delay in Election

China, one of the largest manufacturers in the world is now struggling as recently its consumer price index (CPI) dropped by 0.3% from last year and the producer price index (PPI) has dropped to 0.4% for the 10th consecutive time due resulting in increasing deflation. According to China’s National Bureau of Statistics (NBS)’ July’s report, the Consumer Price index (CPI) has dropped to 0.3%, it was 2nd recurrence of negative inflation reading ever since early 2021.

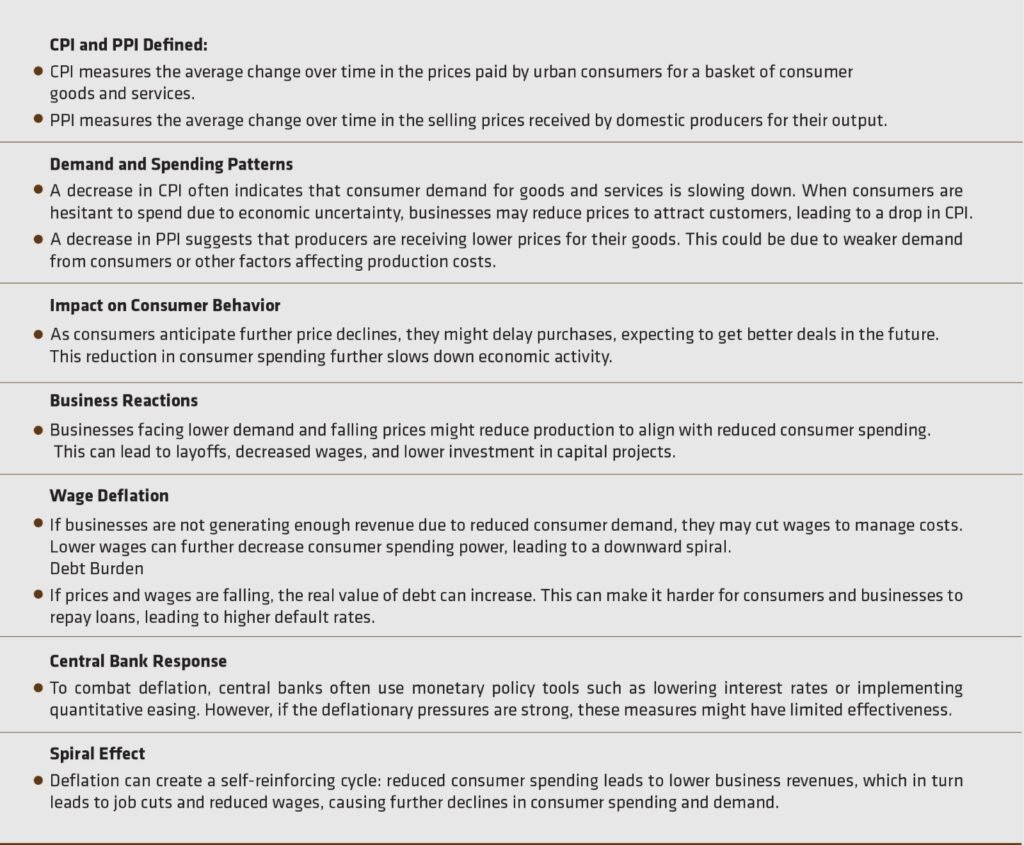

How Deflation Works here

A drop in Consumer Price Index (CPI) and Producer Price Index (PPI) can contribute to deflation in a country’s economy through a chain of interconnected economic mechanisms. Let’s break down the process:

China skillfully managed twice to escape the deflation of 2009 amid the global financial crisis, and once more in 2012 despite encountering subdued foreign and domestic demand. However, the process of economic recovery was less complex back then. Over the last ten years, real estate values have surged due to substantial injections of funds by China’s central bank, aimed at maintaining robust economic expansion and preventing the renminbi, China’s currency, from strengthening to a point that could erode the export competitiveness of its manufacturing sector. But after pandemic, this year the tables turned differently and this time China’s deflation is expected to lead to more calls for government stimulus as their CPI and PPI has dropped in a significant rate, even Xi Jinping’s government is also trying to address weakening trade activity and the slowdown in China’s property sector following China’s inside political unrest, sudden cases of minister exemptions, multiple policy failures also fueling to the rise of deflation.

Increasing Deflation in China

On 8th July 2023, separate data revealed that, the country has experienced more significant declines in both imports and exports than anticipated in the previous month. This drop was attributed to a diminishing global demand for Chinese goods. Retailers within China have been negatively impacted by reduced sales, while businesses that had stockpiled merchandise in anticipation of increased demand following the easing of pandemic-related restrictions are now facing pressure to reduce prices. The cost of cars has also fallen after Tesla triggered a price war in China’s electric vehicle market by reducing its prices. Falling food prices also pulled down the cost of living. Excluding food and energy expenses, China’s core inflation rate saw a year-on-year increase to +0.8%, a rise from +0.4% in June. The country’s producer price inflation, which measures factory gate prices, registered a decline of -4.4% in July, following a 5.4% year-on-year decrease in June. Because of these, China’s economy is moving toward a state of deflation.

Severity of this Deflation

While the notion of declining prices might appeal to Western consumers, especially given the significant inflation experienced over the past year, particularly in the UK where consumer prices escalated by 7.9% in June compared to the previous year, the continuous drop in prices, known as deflation, can impede economic expansion. Deflation can have detrimental effects on economic growth since consumers often postpone their purchases in anticipation of even lower prices in the future. This behavior subsequently prompts businesses to reduce their investments due to diminishing profits. Ultimately, this can lead to a halt in hiring, potential staff layoffs, and an overall slowdown in economic activity.

Another following report of 9th July, 2023 revealed that, China’s exports, and imports both are slumping in July along with debt troubles in China’s property sector. China is also struggling with depts of core sectors. Though the price is declining, the consumers and companies are hoarding cash rather than spending or investing it in concern of risk. Also, China’s shares are on the defensive since July indicating that the economic recovery has been losing steam in Global Stock Market.

China Entering New Dark Era

China is the first G20 economy to announce a year-on-year reduction in CPI ever since Japan’s previous occurrence in August 2021. This decline raises additional worries about the impact on business within significant trading partners. Such deflation leads the concerns of China entering a new Dark Era similar to Japan’s ‘Lost Decade’. From 1991 through 2001, Japan experienced a period of economic stagnation and price deflation known as “Japan’s Lost Decade.” While the Japanese economy outgrew this period, it did so at a much slower pace than other industrialized nations. During this period, the Japanese economy suffered from both a credit crunch and a liquidity trap.

Contradicting Angles of China’s Deflation

China’s subdued price levels contrast starkly with the high inflation experienced in many major economies, prompting swift interest rate hikes by central banks. However, global inflation seems to be showing signs of peaking and even reversing. Notably, Brazil recently lowered interest rates due to more favorable inflation conditions.

China has set a consumer inflation target of about 3% for the year, up from 2% in 2022. Authorities are currently downplaying deflation concerns. Deputy Governor Liu Guoqiang of the central bank reassured that deflation risks in China’s second half of the year are unlikely, attributing any challenges to the economy’s post-pandemic recovery. The decline in China’s Consumer Price Index (CPI) in July was largely driven by a significant drop in pork prices, falling from 26% to 7.2%, as weak consumption coincided with ample supplies. Surprisingly, the CPI increased 0.2% monthly, defying expectations of a decrease, propelled by increased holiday travel. Core inflation, excluding food and fuel costs, rose to 0.8% year-on-year from June’s 0.4%. Some analysts caution against prematurely drawing parallels with Japan’s situation.