As Bangladesh and India formally open trade through local currencies Taka and Rupee from 11 July, experts are upbeat about the US-dollar-system alternative.

The bilateral move comes at a time when many countries across the world are seeking to reduce their dependency on the overheated US dollar.

Recent developments suggest a shifting landscape in global trade, called “de-dollarization”.

The US dollar value has seen a surge by almost 10% since the Russia-Ukraine war began in 2022 – and almost 30% since a decade ago.

This is making several countries opt for foreign trade in alternative currencies – such as the Indian rupee, Chinese yuan or the Russian ruble.

At Tuesday’s launch event in Dhaka, Bangladesh Bank Governor Abdur Rouf Talukder said that this “will increase trade” and “open up a new window to go in a big way into the big market of India”. He referred also to a dual currency card that will likely be introduced by December.

Change of menu: Appetite for new currencies?

Last year, Bangladesh also announced the use of the Chinese yuan in international transactions, following a 2018 agreement that allowed banks to maintain foreign currency clearing accounts in yuan.

According to data by the Bangladesh Bank, the share of yuan in forex reserves has now increased from 1% in 2017 to nearly 1.4% in 2022. Other reserve currencies such as the euro and the pound sterling have also seen a surge, ranging between 4-5% of the total forex reserves composition.

However, the US dollar still has the largest share at 75% in 2022, down from 81% in 2017.

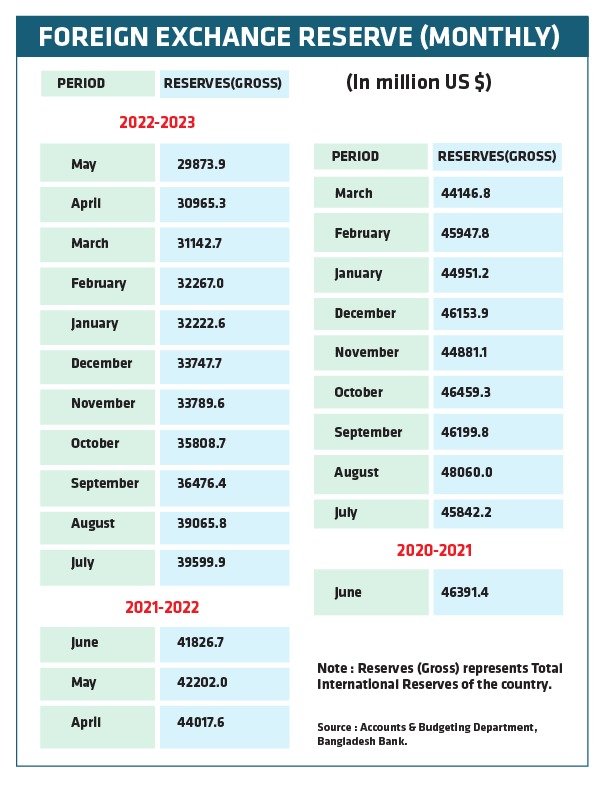

In May 2023, Bangladesh reported its dollar reserves at $30 billion, (https://www.bb.org.bd/en/index.php/econdata/intreserve) after having hit a high of $48 billion in August 2021, and remaining at $46 billion in February 2022 when the Ukraine war began.

The move to trade in the Indian rupee, experts say, will add to the country’s measures to strengthen its forex reserves and remove the conversion loss, which happens when transactions are first converted to the US dollar and then to either rupee or taka.

Delhi-Dhaka: The way forward

India and Bangladesh have maintained growth in bilateral trade despite challenges faced due to the Covid-19 crisis and the Russia-Ukraine war.

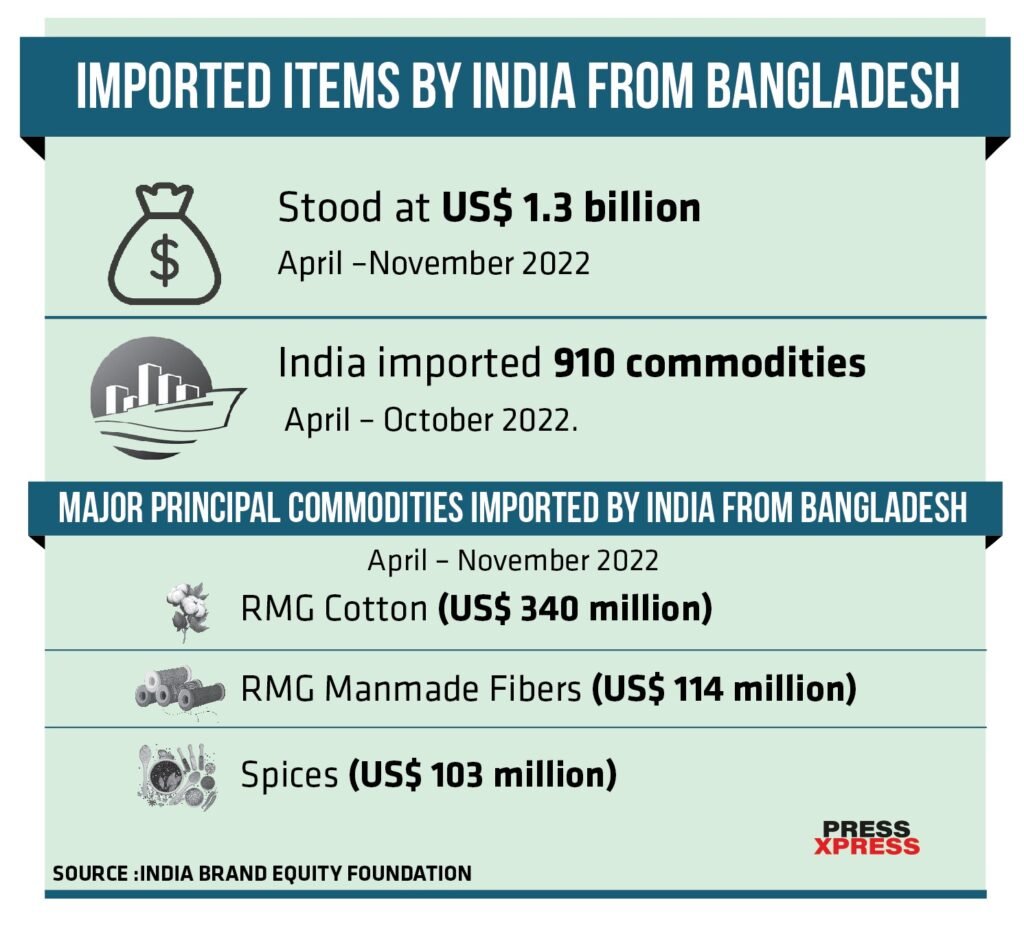

Bangladesh is India’s biggest trading partner in the Indian subcontinent and India is the second biggest export partner accounting for 12% of the total exports to Bangladesh.

The total trade turnover in 2021-2022 touched $18.2 billion, according to the Indian Brand Equity Foundation, an economic knowledge center of the Indian government.

INDO-BANGLADESH BILATERAL TRADE FY22

Therefore, Tuesday’s launch of taka-rupee transactions will ease the process on both sides of the border especially by allowing letters of credit in rupee, which guarantee payments by banks to exporters.

Four banks, including one state-owned bank and one private bank from each country will begin the initial trade transactions. Bangladesh’s State-owned Sonali Bank and the private Eastern Bank have already opened “nostro” accounts in rupees with the State Bank of India and the privately-owned ICICI Bank in India.

The nostro accounts ease international trade by allowing a country’s banks to use foreign banks for trading in the currency of that jurisdiction.

However, this is being seen as only a small step given the huge imbalance in Indo-Bangladesh trade, many experts say.

Bangladesh’s imports from India far outweigh exports. Its exports stand at $2 billion against imports of nearly $14 billion through official channels.

“I am not just looking into this $2 billion export,” Talukder announced at the launch event on Tuesday, adding that this will impact both countries’ exporters and importers. “We can increase our exports manifold, because customers in India will be buying things in their own currency, considering it as their own product,” Talukder told media present at the event.

But some experts differ.

“This is a huge challenge,” said Dr Prabir De, professor at the New Delhi-based Research and Information System for Developing Countries (RIS) and a leading expert on the subject.

“How will Bangladesh tackle the huge trade deficit of $12 billion? There will soon be a surge in demand for the Indian rupee in Bangladesh.” Dr De told Press Xpress in an exclusive conversation.

“Bangladesh central bank needs to inject lot of rupee into the economy by selling dollar forex reserves to meet the upcoming demand,” he added.

Informal trade between the two next-door neighbors is also deemed huge.

According to rough estimates in media reports, the informal trade between India and Bangladesh could be around $25 billion.

“It happens mostly through local communities residing in the border districts of the Indian states of West Bengal, Tripura, Assam, and Meghalaya where barter system runs high to avoid taxation,” explained Dr De. “The advantage, particularly for India, will be to reduce its financial losses by curbing this informal and unreported contraband.”

Dual currency card

Later this year, the Bangladesh Bank is also expected to launch a dual currency debit card called the “Taka Pay Card”.

This card will allow its bearers to withdraw both rupees and taka, which means it can be used in both the countries. This is especially useful for Bangladeshi tourists who visit India for medical care, tourism, and religious reasons. Last year for example, 15 lakh Indian tourist visas were issued to Bangladeshi citizens.

With this card, they will be able to spend up to a limit of $12,000 in rupees when in India.

But experts feel this is just a small beginning and vouch for integration of digital payment systems, such as QR codes or UPI (Unified Payments Interface).

India has already integrated its UPI system with Singapore’s PayNow, said an economist working on Indo-Bangladesh trade on condition of anonymity.

Doing something similar with Bangladesh is what will really help dual currency transactions, she said.

But that is likely to take time.

For now, it is important to note that the US dollar remains dominant in global forex reserves even though its share in global forex reserves has dropped from more than 70% in 1999 to over 58% last year, according to IMF data.

Analysts say changing global dynamics and geopolitical risks will continue to drive the de-dollarization trend, calling it a domino effect.

Calls to move away from the US dollar will grow and local currency trade will allow traders to weigh risks, have more options to invest, and ease their conversion losses.

INTERVIEW

One of the more intriguing financial trends of 2023 has been the talk about de-dollarization. Calls have grown across several countries to trade in home currencies, bypassing the dollar, which has dominated international trade for years. China and Russia are said to be leading efforts in this direction. Many say the dollar appears to be losing its hegemony.

As Bangladesh and India formally open trade in Taka and Rupee, is this a good alternative? Will it help ease pressure on the country’s forex reserves? And are there any red flags that the central bank must prepare against?

In an exclusive interview, Press Xpress’ Tulika Bhatnagar spoke to Dr Mizanur Rahman, Commissioner, Bangladesh Securities and Exchange Commission (BSEC) about the dollar-dominated forex reserve and how one must tread cautiously in diversifying the forex reserve in view of the globally integrated market.

Q. Bangladesh has taken small measures to diversify its forex reserves in the last few years. Last year, Dhaka also announced expansion in use of the Chinese yuan in international transactions. According to data by the Bangladesh Bank, the share of yuan in forex reserves has now increased from 1% in 2017 to nearly 1.4% in 2022. Do you see shares of other currencies increasing in FY22-23? If yes, by how much?

A. The foreign exchange reserve of Bangladesh is mostly comprised of the US dollar and the highly liquid US dollar-denominated securities. The role of other major currencies such as the euro, Japanese yen, Chinese yuan or Indian rupee is still quite limited. In fact, this is a global trend across developing and emerging market economies. The fact is, the US dollar is the world’s dominant vehicle currency. It accounts for 89% of the $7.5 trillion daily turnover in over-the-counter (OTC) forex markets across the world, according to data by the Bank for International Settlements. Keeping this in mind, the use of yuan and rupee in Bangladesh’ international trade will be more transactional than generalized. I do not expect a substantial change in the Bangladesh central bank’s basket of forex reserves. Our country’s integrated OTC forex market will continue to be primarily based on the US dollar.

Q. Bangladesh’s imports from India far outweigh exports. Its exports stand at $2 billion against imports of nearly $14 billion through official channels. How will Bangladesh tackle the huge trade deficit of $12 billion? There will soon be a surge in demand for the Indian rupee in the market. What measures should Bangladesh take to meet this demand?

A. You are correct. Bangladesh had a bilateral trade deficit of $12 billion against India in FY22. If the entire bilateral trade was invoiced in Indian rupee, for example, there would be an excess demand for Indian rupee to the tune of $12 billion. Ideally speaking, Bangladesh Bank would be obliged to act as the market maker for a foreign exchange market in Indian Rupee. The central bank must prepare to fill gaps in the demand and supply and avoid a liquidity shortage of rupee.

What are the challenges that the central bank needs to prepare for? One is, the bank will have to significantly diversify its forex reserves into rupee-denominated financial assets. Given that India does not have capital account convertibility, any significant diversification of forex reserves into rupee-assets will make it susceptible to unforseen exchange rate volatility, pariticuarly unforseen depreciation of rupee against the dollar. The other is that buying rupee in exchange of the dollar will incur relatively large transaction costs. How large will it be? It can be more than 10x of transaction cost of trading in the US dollars.

In summary, I will argue that three factors will prove to be very significant in how Bangladesh tackles diversifying its foreign exchange reserves to include more Indian rupee in place of the US dollar. These are: prohibitve transaction costs, no capital account convertibility of India, and relative illiquidity of rupee-denominated financial assets in global foreign exchange markets.

Q. How will Taka-Rupee trade impact informal trade between the two countries? What is the approximate value of informal trade – is it okay to say it is over $25 billion?

A. I admit that there exists a large informal trade between India and Bangladesh. I am not aware of any reliable estimate of its size. Currently, traders settle underlying payment obligations mostly via Hundi or Hawala. It operates like this. Both the Indian RBI central bank and the Bangladesh Bank have actively intervened in their respective forex markets in order to peg their national currencies to the US dollar. So the traders of the bilateral informal trade get a derivative of exchange rate of Taka per unit of rupee strictly depending on exchange rates of either currencies against the dollar. Money exchange houses play a big role to organize this market. Note that exporters, importers, and currency traders of both India and Bangladesh closely monitor daily movements of exchange rates of local currencies against the dollar in their kerb forex markets where the dollar is the invoice currency. I don’t see any significant change in the way informal trade will be settled in the foreseeable future.

Q. What are the immediate top three challenges and benefits for Bangladesh?

A. The new international payment settlement which will involve Indian Rupee as the invoice and settlement currency will face a number of immediate challenges. Firstly, It will cause inefficient fragmentation of the prevailing foreign exchange market, which is dollar-based and globally integrated. Secondly, Bangladesh Bank will need to diversify its portfolio of foreign exchange (FX) reserves giving significantly larger weights to rupees. That will complicate monetary and exchange rate policies of the central bank. Thirdly and most intriguingly, such diversification of FX portfolio will not be profit maximising for Bangladeshi exporters and importers, domestic corporate borrowers in foreign currencies, nor for Bangladesh Bank. It is likely that Indian exporters may not prefer invoicing their exports even in their national currencies, not to mention Bangladeshi Taka. It is because of prohibitive exchange rate uncertainty and the lack of instantaneous liquidity of financial assets denominated in rupee. In fact, the market for government securities or AAA-rated corporate bonds which are denominated by rupee is mostly localised. Its weight in the global financial market is insignificant. An implication is that corporations will incur prohibitive transaction costs (broadly defined) in settlement of their international payment obligations in this new mechanism.

Consider this example. If the rupee depreciates by 10% against the dollar in a period of six months, which is the typical credit period of an export, the Indian exporter would lose 10% value of exports in terms of the dollar because of a rupee-invoicing. The counterparties in Bangladesh, that is, importers, will face a dysfunctional foreign exchange market in rupee. As I explained earlier, those markets will be illiquid and costly. So all parties to trade will incur larger costs and exchange uncertainties. International trade and finance will likely decline in this case. This is a significant challenge. So all parties to trade must have solutions to deal with such a situation.

Think about a scenario that a government-owned corporation in Dhaka will have an Indian Rupee loan due for settlement on 31 December 2023. Given the gap in demand and supply, the Bangladesh Bank will need to convert their US dollar reserves into rupees and supply the same to the local forex market in Indian rupee. As the prevailing foreign exchange market is predominantly dollar-based and globally integrated, Bangladesh must balance diversification with the risk of fragmentation.

Finally, one must be cautious against peripheral currencies for managing external debt of both public and private sectors of a developing country. As of 30 June 2022, more than 90% of public sector external debt, which is approximately 75 billion US dollars, is dollar-denominated. Almost 100% of private sector external debt, which is approximately $25 billion, is also dollar-denominated. While the external indebtedness of the public sector is long-term and low-cost, that of the private sector is mostly short-term, variable-rated and unhedged. Faced with such a condition, any diversification of foreign exchange reserves into peripheral currencies may increase sovereign risks and downgrade global rating of the country. It is hoped that such issues are taken into consideration and are well thought out when charting out further policies for exchange rate and forex reserve management.