Bangladesh, classified as a third-world country, has experienced remarkable growth in its burgeoning apparel industry. This sector has played a crucial role in the country’s economic development by contributing significantly to its foreign exchange earnings. In fact, the apparel industry accounts for more than 80% of Bangladesh’s export revenue.

You Can Also Read: BANGLADESH’S MERCHANDISE EXPORTS TO THE UK REACHES A HISTORIC $5 BILLION

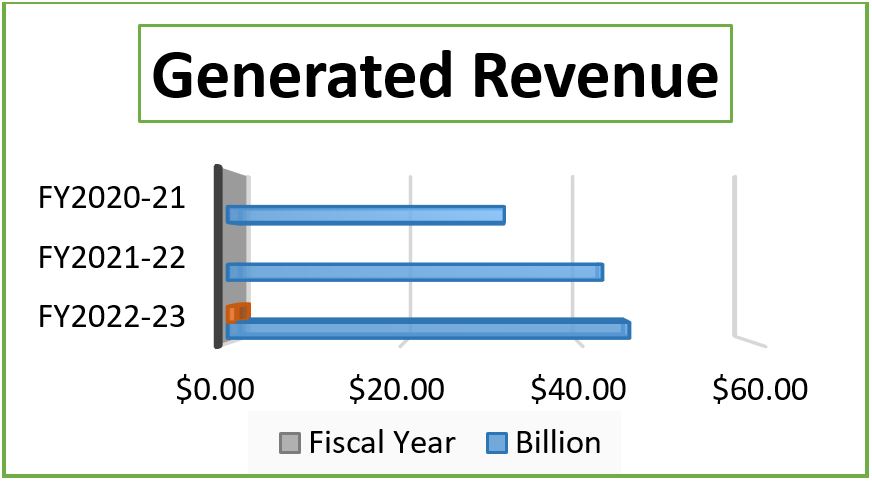

It is truly exhilarating to witness the sector’s revival from the challenges it faced during the pandemic. Despite the obstacles, the readymade garment sector managed to rebound, demonstrating a steady increase in exports. In the fiscal year 2020-21, it generated approximately $31.456 billion, a figure that escalated to $42.613 billion in the following fiscal year of 2021-22. Notably, during the July-April period of the 2022-23 fiscal year, the readymade garment sector alone contributed around $38.57 billion, marking a remarkable 9.09% growth compared to the same period in the previous fiscal year.

RMG Facing the Cumulative Effect of Traditional Market

Despite the overall positive facts, a closer examination of monthly statistics highlights a recent decrease in the growth of RMG apparel exports. Specifically, in April, Bangladesh’s readymade garments (RMG) exports experienced a notable decline of 15.48%, totalling $3.32 billion compared to April 2022. The cumulative impact of these declines has contributed to an overall downward trend in recent months, which contrasts with the otherwise positive trajectory observed during the mentioned period in the fiscal year 2022-2023 from new and non-traditional market of Bangladesh’s RMG Apparel industry.

According to the Export Promotion Bureau (EPB), woven and knitted apparel, clothing accessories and home textile exports together accounted for 86.51 per cent of Bangladesh’s total exports of $45.677 billion during July- March FY23 from the traditional and major textile market of Bangladesh like Germany and the USA.

Mohiuddin Rubel the Director of BGMEA stated that, “Our target was $46.80 billion, and we had to ensure a 9.83% growth. There are two months left in this financial year, so in these two months, we have to meet the target of about $8 billion,”

“In April, our export target was $4.07 billion against $3.32 billion target. We exported 18.40% less than our target this month. And compared to this month last year, our exports decreased by 15.48%. This is the lowest single month export this year.”- Mohiuddin added.

Expansion to Potential New Market

Citing official data, the report highlights Australia, Japan, and India as key markets that have contributed to the increased export of apparel products from Bangladesh, with earnings from each of these countries surpassing one billion dollars. In contrast, the country’s export revenue from major existing markets like Germany and the USA declined during the same period. Industry experts point out that there are 15 potential markets beyond the three traditional export destinations (the United States, the European Union, and Canada), including Australia, Brazil, Chile, China, India, Japan, Korea, Mexico, Russia, South Africa, the United Arab Emirates, Malaysia, Saudi Arabia, New Zealand, and Turkey.

Prime minister Sheikh Hasina on the celebration event of National Textiles Day-2022, asked all concerned to explore new markets for Bangladeshi garments with invention of newer items keeping pace with its ever-changing trend.

PM stated that, “They, who are working with garments and their exports, will have to find new markets. Newer products will have to be produced keeping in mind that the choices vary with different countries.”

On basis of which the potential of these new destinations, along with others, has garnered significant attention from Bangladesh’s exporters. This focus is a result of their efforts to expand into new markets and diversify their product offerings. These initiatives have been spurred by various factors such as the sluggish demand caused by the COVID-19 pandemic, high inflation, rising interest rates, and the impact of the Russia-Ukraine war on the major markets of the European Union and the United States.

Potential Challenges of RMG

Product development:

It is noteworthy that Bangladesh’s apparel exports have predominantly grown by targeting the European Union and North American markets over the years. Reliance on these major markets have made it challenging to simultaneously explore other markets, as it necessitates product development and adaptation tailored to the preferences and choices of consumers in those markets. This challenge has dissuaded many exporters from actively pursuing market expansion, despite the risks associated with over-reliance on the major markets. However, there has been a recent shift in this scenario, evident from the country’s export performance in new markets in recent years. While this accomplishment is commendable, it is important to recognize that exploring new avenues for the expansion of the apparel business requires persistent efforts in understanding the unique preferences of consumers in those markets and ensuring compliance with varying norms from country to country.

Technological advancement:

By 2023, the apparel industry has become largely mechanised, and the position in Bangladesh can be lifted as a leading exporter of ready-made garments, by adopting various modern technologies. The use of technology in the apparel industry has revolutionised the way clothes are designed, produced, and sold. With the advent of 3D printing and other rapid prototyping technologies, clothes can now be designed and produced with unprecedented speed and accuracy. Bangladesh has emerged as the leading exporter of ready-made garments in large part due to its low labour costs. However, as machines take over more and more of the tasks that were once done by human workers, the importance of low labour costs will diminish. Given its location, Bangladesh is at risk of increased competition from China and other Asian countries in the potential market. If Bangladesh hopes to remain competitive, it must invest in technological advancements that can improve productivity and efficiency. Furthermore, the country must focus on improving quality control measures in order to reduce defective products.

Navigating towards Short Runs

In a recent development, the European Union has reached an agreement to prohibit the practice of destroying unsold clothing. This decision aligns with their efforts to tackle waste, promote reuse, and enhance recycling practices. The proposed legislation comes in response to mounting concerns regarding the accumulation of surplus clothing within the EU Bloc. This issue has arisen due to the increasing popularity of online shopping and the high rate of product returns, which directly impact the production and export of readymade garments in both existing and potential markets.

It is argued that the destruction of unsold clothing not only represents a waste of valuable resources but also contributes to substantial carbon emissions. Concurrently, suppliers in Bangladesh are observing a related trend with an increasing demand from customers for shorter production runs. This shift holds significant implications for Bangladesh, given that its apparel industry has established a reputation for efficiently fulfilling large orders within tight timelines.