This June Bangladesh saw expatriate Bangladeshis hitting a new record of remittance inflow in FY23. The Information was established by Central Bank, Bangladesh on July 1st, 2023. This acceleration is considered the highest amount of received remittance within the past three fiscal years.

The country’s remittance has always played a crucial role in the domestic economy of every fiscal year, though during the pandemic the remittance inflow did face a drastic obstacle. Now that the country is finally pulling back and thriving, the expatriate Bangladeshis have also increased their regularity of sending remittances which have hit a new record in this Jun of fiscal year 2022- 2023.

Eid-ul-Adha Fuelling Remittance Flow Acceleration

According to the information from the Central Bank, Bangladesh has received a total remittance of $21.61 billion in the fiscal year 2022-23 which is 2.75% higher than the previous fiscal year. In the fiscal year 2021-22, a total of $21.03 billion was received through formal channels in the country. Whereas in the month of June, $2.12 billion in remittances was received by Bangladesh through banking channels. This up-strike of remittance inflow is being considered as a record compared to the previous two fiscal years, coinciding with the occasion of Eid-ul-Adha. Prior to this, in July 2020, the highest remittance of $2.59 billion was received.

You can also read: What are the key changes in Bangladesh’s RPO Bill 2023 ahead of election?

Out of the remittances received in June through formal channels, $447 million came through state-owned banks. However, the majority of the remittances were received through 43 private banks. In June, these banks received around $1.75 billion in remittances. On the other hand, 9 foreign banks received $6 million. Comparatively, in the past 12 months, the highest amount of $17.61 billion in remittances was received through private banks. In contrast, $3.92 billion came through state-owned banks.

According to the information from the Central Bank, in the month of May, remittances sent through banking channels amounted to $1.69 billion. The same month of the previous year saw a higher amount of $1.88 billion.

Remittance Inflow Impacting Foreign Exchange Reserve

Bangladesh Foreign Exchange Reserves were measured at 26.2 USD billion in May 2023, compared with 27.2 USD billion in May 2023 which is comparatively lower than FY2021-2022. As in FY21, Foreign Exchange Reserves were measured at 44.62 USD billion which was approximately 1.7 times greater than FY23 while the pandemic was in its second phase in Bangladesh. In World Bank’s “Bangladesh Development Update, April 2023”, such deflation of remittance is weighed down by elevated inflation, tighter financial conditions, disruptive import restrictions, and global economic uncertainty and is expected to deteriorate further by 5.2%.

Post Pandemic Foreign Exchange Reserve Deterioration

According to official data, Bangladesh’s foreign exchange reserves have declined to a six-year low of $31.15 billion. This drop can be attributed to the central bank’s settlement of import bills totalling $1.05 billion with various Asian nations. It indicates a significant decrease of approximately 30 percent from the reserve amount of $44.14 billion reported in March of the previous year. The current reserve level is the lowest observed since the financial year 2016-17 when it stood at $33.49 billion let alone the past three years.

The import payments were resolved by the Bangladesh Bank (BB) through the Asian Clearing Union (ACU). According to Central Bank, Bangladesh’s foreign exchange reserves have experienced a significant decline in recent months of 2023 following each payment made through the Asian Clearing Union (ACU). In August 2021, the reserves reached an all-time high of $44 billion.

However, starting from May 2022, the reserves have been on a downward trend due to increased import payments resulting from elevated commodity prices, which were impacted by the ongoing Russia-Ukraine war.

ABB Sticks to Their Doller Selling Policy

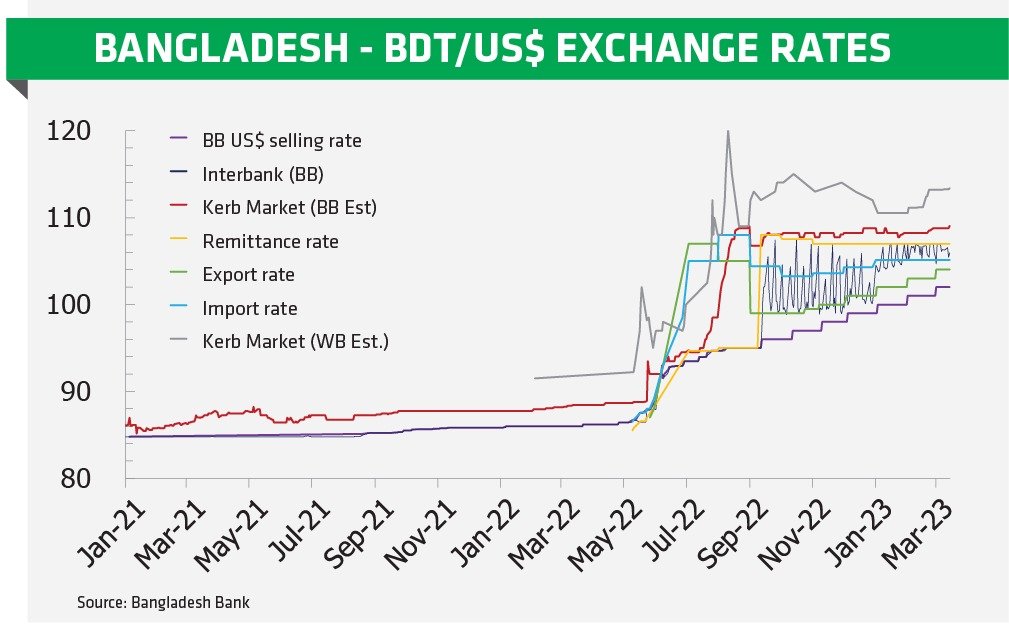

The Association of Bankers, Bangladesh (ABB) and the Bangladesh Foreign Exchange Dealers Association (BAFEDA) decided that banks can buy dollars at a maximum rate of 108.50 BDT for each dollar of remittance on May 31 of FY23. Before this, on April 30, the exchange rate for remittances and export earnings was set at TK108 BDT respectively.

However, the Bangladesh Bank has stated that although the exchange rate for remittances was set at 108 BDT in May, the banks sold dollars at a rate of TK108.75 BDT per dollar, which is the highest rate of selling dollars as well.