China’s Yuan has dropped to six-month lows against the dollar, and analysts say it could fall further as investors struggle over a rocky pandemic recovery in the world’s second-largest economy.

With recent data showing a decline in manufacturing and weaker services activity, China’s economic recovery and Chinese currency, Yuan face serious obstacles. Since January, China’s economy has had a direct effect on the depreciation of the Yuan, which has fallen more than 5 percent against the rising dollar.

Weakening economic recovery and impact on Yuan’s depreciation

The Yuan’s depreciation against the dollar has been influenced by unsatisfactory economic data, widening yield differentials with the United States (US), and ongoing capital outflows through the sale of equities and bonds by foreign investors. The performance of the currency reflects the difficulties of China’s economic recovery post-Covid. “The Yuan suffers as China’s reopening story is less appealing than before, and there is no sign of further stimulus,” said Gary Ng, senior economist for Asia Pacific at Natixis.

With recent data showing a decline in manufacturing and weaker services activity, China’s economic recovery and the Chinese currency, the Yuan, face serious obstacles. Since January, the depreciation of the Yuan against the dollar has been influenced by disappointing economic data, widening yield differentials with the United States (US), and ongoing capital outflows through the sale of equities and bonds by foreign investors. The performance of the currency reflects the difficulties of China’s economic recovery post-Covid. “The Yuan suffers as China’s reopening prospects are less appealing than before, and there is no sign of further stimulus,” said Gary Ng, senior economist for Asia Pacific at Natixis.

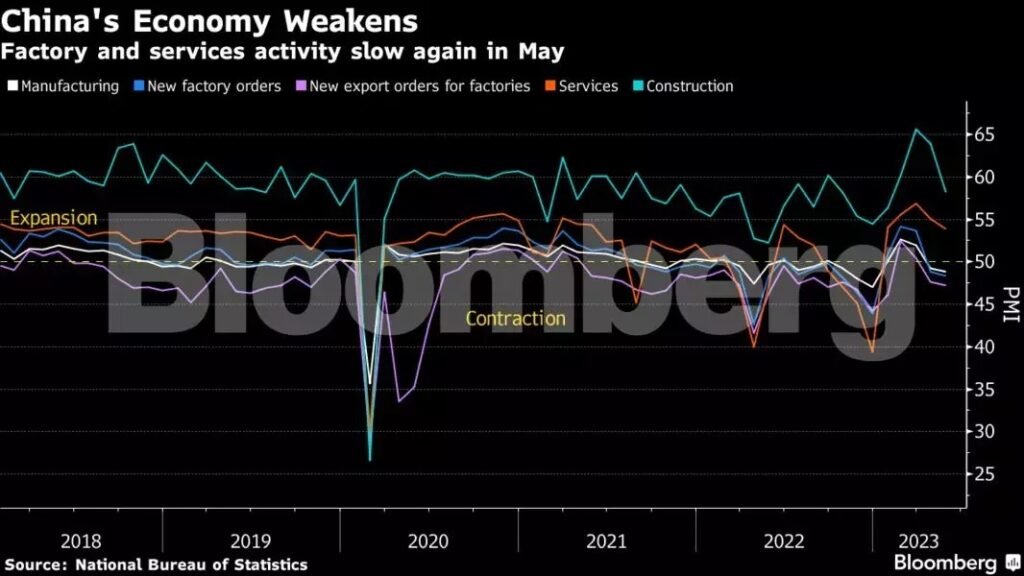

In May, China’s economic recovery weakened, with manufacturing activity contracting at a more rapid rate than in April. This prompted calls for more central bank action to counter the downturn and raised new concerns about the growth outlook. The decline in overseas markets, declining global demand, and falling new orders have further diminished China’s export prospects, impacting the nation’s economic recovery.

The difficulties confronting China’s economic recovery are evident in a variety of basic materials markets. Futures markets for commodities such as glass, styrene, and corn starch reflect the slower-than-anticipated economic recovery, highlighting its deeper impact on the economy. In addition, China’s consumer prices rose at the weakest rate in over two years, while factory gate deflation accelerated, indicating the need for additional stimulus to support the post-COVID economic recovery. China’s directive to reduce interest rates paid on certain deposits by its “big four” state-owned institutions also contributed to the depreciation of the Yuan in April. Earlier, analysts had predicted that a further depreciation of the Yuan would lead to a decline in the yields on Chinese government bonds. Meanwhile, the global dollar index rose, and the offshore Yuan traded at a discount to its onshore counterpart.

Concerns over falling exports and weakening Yuan

China’s export sector, which has been an enormous boost for the economy in recent years, is facing challenges as global demand softens, resulting in a decline in new orders. The Chinese Ministry of Commerce has been inquiring about currency strategies to determine the potential impact of a weakening Yuan on exporters, importers, and banks’ businesses. While the central bank has tools to manage currency fluctuations, it has signalled a desire to limit excessive exchange rate fluctuations. There have been few reported instances of government agencies intervening to support the Yuan despite its recent decline.

Experts call for additional central bank action to combat the economic downturn amid concerns about the growth outlook. However, the People’s Bank of China (PBOC) appears to be tolerant of a weaker Yuan, with its recent official Yuan midpoint guidance rates aligning with market expectations. Market analysts such as Alvin Tan of RBC Capital Markets and Tommy Wu of Commerzbank believe that the central bank is content to allow the rising U.S. currency to push the Yuan down as a form of monetary easing.

Implications of a Weaker Yuan

A devalued Yuan can increase exporters’ profits when converting dollar receivables into Yuan. Furthermore, a devalued currency could enhance export performance, particularly as global trade continues to contract this year. Despite recent declines and a six-month low, the Chinese offshore Yuan gained over 0.1% in the most recent session. According to a private sector survey, China’s factory activity unexpectedly increased in May as a result of increased production and demand. However, the Yuan depreciated by nearly three percent against the dollar in May, reflecting the obstacles China’s economic recovery faces.

Yet, expectations of sustained currency depreciation may discourage capital flows into yuan-denominated assets as investors worry about the potential for foreign exchange losses. Barclays’ FX strategist, Lemon Zhang, said, “But a weak currency expectation going forward is not helping capital flows, as investors are concerned about FX losses when they look at Yuan-denominated assets.” On the other hand, a weaker Yuan could alleviate deflationary pressures in certain sectors of the economy caused by sluggish domestic demand. The stability of the implied volatility for the currency indicates that market participants do not anticipate significant fluctuations.

Market observers speculate that the PBOC might impose a cap on dollar deposit rates to encourage companies to reduce their dollar holdings, easing downside pressure on the Yuan. However, Chinese analysts believe that the short-term depreciation of the Chinese currency does not indicate an imminent further decline. They believe that the pace of China’s economic recovery and the difference in economic development between major economies such as Europe, the United States, and China will have a significant impact on the value of the Yuan.

Lastly, market expectations and forecasts suggest a moderate depreciation of the Yuan (not beyond 7.3 against the dollar this year). The stability of the Yuan and its impact on the broader economy will depend on various factors, including economic growth differentials and market sentiment.