The budget for fiscal year 2023-2024 is the first step in constructing a Smart Bangladesh and the goal of the budget is a Bangladesh free of hunger and destitution, based on knowledge, and developed.

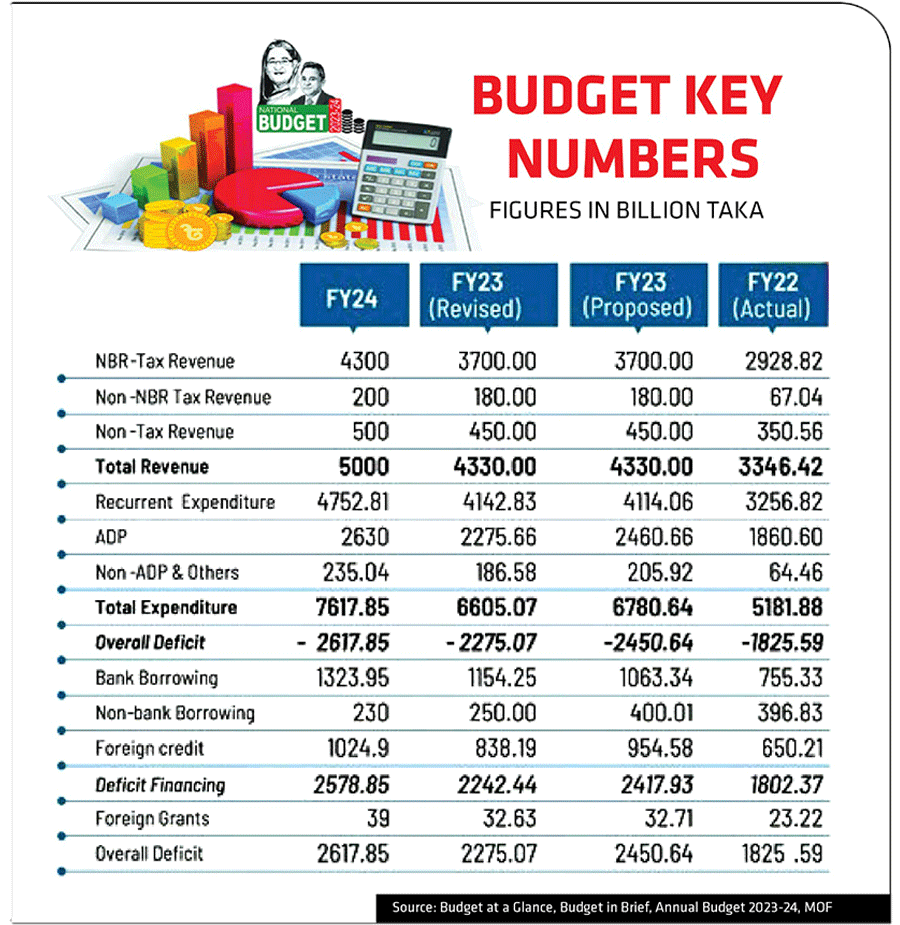

The projected national budget for the fiscal year 2023-24 is estimated to reach TK 7.61 trillion (761,785 crore), representing a noteworthy GDP growth rate of 15.2%. This budget holds significance as it marks the 52nd fiscal plan for the country and the 24th under the tenure of the Awami League, which has been in power for five terms.

YOU CAN ALSO READ: HOW USA TOPPLED GULF NATIONS FOR FOREIGN REMITTANCE INFLOW IN BANGLADESH?

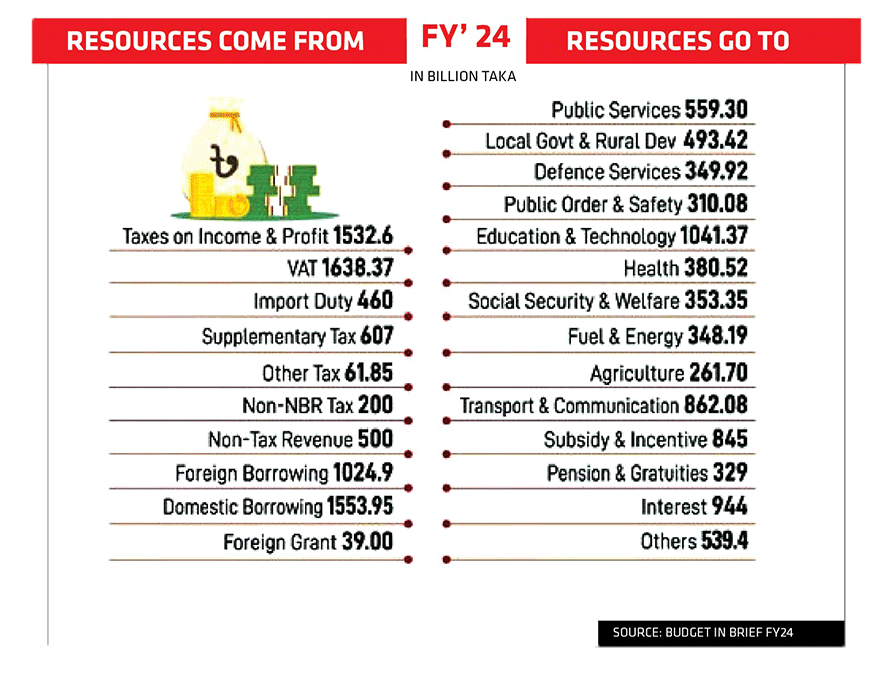

The budget’s revenue objective is TK 5 trillion (500,000 crore). The National Board of Revenue (NBR) is tasked with generating TK 4.3 trillion in revenue, contributing significantly to the total revenue target. However, the budget is projected to face a deficit exceeding TK 2.5 trillion, necessitating additional funding measures.

Let’s look at what might be in the forthcoming budget-

Transport, communication sector allocation to rise:

The proposed budget for the fiscal year 2023-24 in Bangladesh has allocated TK 876.29 billion for the transport and communication sector, which is an increase of TK 61 billion compared to the previous fiscal year. Plans include upgrading national highways, developing railways, modernizing ports, and restoring waterways. Additionally, efforts are being made to expand airports and increase international flights and destinations. These initiatives aim to bolster the transport and communication sector, facilitate efficient movement of goods and people.

Increasing the tax free income ceiling:

There is a strong likelihood that the tax-free income threshold for individuals will be raised in the upcoming budget. Presently, the ceiling for males stands at TK 300,000, but it is anticipated to be increased to a range of TK 320,000 to TK 350,000.

The average inflation rate during the first 10 months (July-April) of the current fiscal year has been recorded at 8.9 percent, eroding the real income of the population. Consequently, people’s actual income has suffered a decline. In light of this, the potential increase in the tax-free income threshold aims to address the adverse impact of inflation on individuals’ purchasing power and provide some relief in terms of taxation burden.

Expense in plot, flat, personal vehicles to increase:

In the forthcoming budget, buyers of flats and plots should anticipate higher taxes, ranging from 10 to 12.5 percent. The overall tax rate could potentially reach 15 percent, resulting in additional financial burdens for individuals purchasing properties. For instance, someone acquiring a TK 10 million flat might face an extra payment of TK 250,000 to TK 500,000. Furthermore, owners of personal vehicles might encounter additional taxes, such as a carbon tax, when purchasing a second vehicle. The specific amount of this tax could range from TK 20,000 to TK 300,000, depending on the variance in engine capacity.

Moreover, there is a possibility that the supplementary duty for cars in the 2001-3000CC range may increase from 200 percent to 250 percent. Similarly, for cars in the 3001-4000CC range, the supplementary duty could rise from 350 percent to 500 percent. These potential tax adjustments reflect the government’s intentions to generate revenue and regulate vehicle ownership and usage within specific engine capacity brackets.

TK 371 billion allocated to deal with impact of climate change:

In a bid to address the impact of climate change and safeguard the environment, Finance Minister AHM Mustafa Kamal has put forth a proposal to allocate TK 370.52 billion in the fiscal year 2023-24. The government’s objective is to pursue sustainable development approaches while sustaining a robust growth trajectory.

Given Bangladesh’s vulnerability to climate change, the focus lies on both adaptation and mitigation measures, with particular attention directed towards adaptation strategies. By prioritising adaptation, the government aims to enhance the nation’s resilience and ability to cope with the challenges posed by climate change.

Social safe net allowance to increase:

In the forthcoming 2023-24 budget, there will be a notable increase in the allocation for social safety net programs. This increase will result in an upward adjustment in the allowance amount per person in certain programs, ranging from TK 50 to TK 100, after a seven-year period. Furthermore, the number of beneficiaries will also witness an expansion alongside the slight increment in the allowance.

In the previous budget for the 2022-23 financial year, the allocation for social safety net programs exceeded TK 1.13 trillion (113,576 crore). However, in the upcoming budget, sources from the financial division indicate an expected increase to over TK 1.26 trillion (126,200 crore).

The forthcoming budget introduces eight schemes for cash assistance, with a TK 30 billion increase in the allocated amount for these programs. These schemes encompass a wide range of beneficiaries, including widows, deserted and destitute women, financially insolvent disabled individuals, transgender (hijra) livelihood improvement programs, support for bede and disadvantaged communities, assistance for oppressed women and children, honorarium for freedom fighters, medical allowances for injured freedom fighters, and pensions for retired government employees and their families.

Increase in travel tax:

In the upcoming 2023-24 fiscal year budget, the government is anticipated to propose an increase in taxes for air, sea, and land travel. This proposal suggests a significant 50% increase in taxes across most instances. If implemented, this measure would lead to a rise in travel costs, making transportation more expensive for individuals.

Increased budget for health and family welfare sector:

The government has put forth a proposal to allocate TK 380.52 billion for the health and family welfare sector in the fiscal year 2023-24. This allocation represents a 3.23% increase compared to the previous year’s allocation

Announcement on universal pension:

As per the last budget speech delivered by Finance Minister AHM Mustafa Kamal, the current government intends to introduce a universal pension scheme. However, the implementation will occur gradually, encompassing six distinct phases targeting different groups. These groups include expatriates, private sector employees, laborers, workers from informal sectors, beneficiaries of the social safety net, and students.

To account for the complexity of this task, the initial phase of the scheme will be optional rather than compulsory. This approach allows for a smoother implementation process. Consequently, there will be no allocation in the upcoming budget specifically designated for the universal pension scheme, as its introduction is set to occur in subsequent phases, not in the immediate fiscal year.

Allocation to increase for food security:

In the ongoing fiscal year, an allocation of TK 154.08 billion has been designated for 11 categories of food security and employment creation programs, such as TR, GR, VWB, OMS, food-friendly programs, and VGF. There is a possibility that the allocation for these programs may witness a TK 20 billion increase. These programs primarily aim to ensure affordable rice and flour for the population while implementing various projects in rural areas to generate employment opportunities.

Additionally, the budget allocation for student stipends may experience a TK 1 billion increment. Currently, the sector receives an allocation of TK 44.17 billion. However, it is important to note that there will be no increase in the amount of scholarships at the individual level.

Increase in proposed budget for education sector:

In the proposed budget for the fiscal year 2023-24, the government has allocated a significantly higher budget for the education sector, witnessing a growth of approximately 25.04%. A total of TK 88,162 crore has been designated for the education sector, surpassing the revised budget of FY 2022-23 by TK 17,665 crore.

The finance minister’s proposal includes TK 34,722 crore for primary and mass education, TK 42,838 crore for secondary and higher education, and TK 10,602 crore for the Technical and Madrasa Education Division. In the upcoming financial year, there are plans to provide training to 4,000 individuals, including education managers and teachers, through 90 training courses. Additionally, 15 research programs focusing on education and teacher training will be conducted.

Although, the government allocates a higher budget to the education sector, emphasizing improved educational opportunities and teacher training, but the percent of budget on education sector experiences a decline considering the last year’s one. In 2022-23, it was 1.83 percent of the total GDP. But in the proposed budget, it is said to be hold only 1.76 percent of the GDP, where the UNESCO said to keep it at least 6 percent.

Increased budget allocation for defense ministry:

In the proposed budget for the fiscal year (FY) 2023-24, the government has allocated TK 420.95 billion for the Ministry of Defense. This allocation represents an increase of TK 54.45 billion compared to the revised budget of TK 366.50 billion for the ongoing FY 2022-23. Additionally, the government has proposed an allocation of TK 450 million for the Armed Forces Division in FY 2023-24, which is an increase from the revised budget of TK 370 million in FY 2022-23.

Gender allocation to focus on empowerment:

In the proposed budget for the fiscal year 2023-2024, the Ministry of Women and Child Affairs in Bangladesh has been allocated TK 4,755 crore. This allocation reflects an increase compared to the previous budget, demonstrating the government’s commitment to women and children’s welfare.

The budget encompasses various initiatives aimed at promoting the well-being of women and children. These initiatives include the establishment of day-care centers, the production and distribution of sanitary towels, the provision of bicycles to school-going girls, and capacity building programs to prevent violence against women and child marriage.

Additionally, allocations have been made for the Information and Communication Technology Division and the health services division to support women’s development in those sectors. The overall gender-related budget for FY2023-24 amounts to TK 175,350.5 crore, with a strong emphasis on empowering women, enhancing their access to public services, and promoting their productivity and participation in the labor force.

Experts highlight the importance of effectively utilizing the allocated funds and closely monitoring their outcomes to ensure the well-being and advancement of women and children in the country.

Budget for EC increased by nearly TK 9 billion:

In the proposed budget for the upcoming fiscal year, the allocation for the Election Commission (EC) in Bangladesh has witnessed a significant increase of nearly TK 9 billion. The budget for the EC Secretariat is set at TK 24 billion for the 2023-24 fiscal year, a notable rise from the previous fiscal year’s allocation of TK 15.39 billion. It is worth mentioning that the allocation for the EC was revised to TK 14.23 billion for the outgoing fiscal year.

This increased allocation comes as the country prepares for the 12th national election, which is expected to take place either towards the end of the current year or in early 2024.

Prices to rise and fall

In the upcoming fiscal year, certain essential products are expected to experience price increases, including ballpoint pens, napkins, tissue paper, soap, and plastic household items. These price hikes are anticipated due to the proposed budget for FY 2023-24. Moreover, a range of items such as land, cashew nuts, dates, electric cigarettes, cigarettes, escalators, moving walkways, electric motor parts, sandwich panels, cement, microwave ovens, basmati rice, software, tissues, mobile phones, sunglasses, and plastic tableware and kitchenware may also see price increases.

Conversely, prices of imported fish, sweetmeats, optical fiber cables, handmade biscuits, cakes, animal feed, blenders, juicers, pressure cookers, agricultural equipment, and medicines for malaria are likely to decrease in the upcoming fiscal year.

The proposed budget introduces changes in VAT exemptions for specific products. For instance, the VAT exemption limit for handmade biscuits and cakes has been raised, reducing production costs. The VAT on confectionery services may also be reduced by half from the current 15 percent. Additionally, medicines for cancer, diabetes, malaria, and tuberculosis are expected to become more affordable in the upcoming fiscal year.

Furthermore, the budget suggests VAT exemption on the lease of passenger transport aircraft, aiming to lower leasing costs. Moreover, the government has proposed reducing the duty on container imports to 15 percent, aiming to boost the container business used for import and export activities.

What is waiting for Bangladesh with this budget?

Bangladesh aims for an ambitious GDP growth rate of 15.2% in the upcoming fiscal year, showcasing the government’s commitment to a Smart Bangladesh. Achieving such growth will require careful implementation and monitoring. The revenue target of TK 5 trillion, with TK 4.3 trillion generated by the National Board of Revenue, plays a vital role. However, the projected deficit of over TK 2.5 trillion necessitates additional funding measures.

The government aims to maintain price stability with an anticipated inflation rate of 6.5%. However, consumers may face challenges due to expected price increases for essential products and certain items. Proposed changes in VAT exemptions aim to mitigate costs for specific products and make essential medicines more affordable. Moreover, increased allocation for the health and family welfare sector signifies priority given to enhancing healthcare services.

Individuals may experience relief from the impact of inflation on purchasing power with a potential increase in the tax-free income threshold. However, higher taxes on property purchases and personal vehicles may pose financial burdens and influence consumer behavior in these sectors.

Overall, the budget for fiscal year 2023-24 reflects aspirations for a Smart Bangladesh, focusing on economic growth, infrastructure development, social welfare, and sustainable practices. Effective implementation and monitoring will be crucial to achieving desired outcomes and ensuring inclusive and balanced economic development.

Photo Credit: Yeasin Kabir Joy