The Reserve Bank of India (RBI) has recently made an important decision regarding the withdrawal of Rs 2000 denomination banknotes from circulation. However, it is essential to note that the existing notes will remain legal tender, as announced by the RBI on Friday.

You can also read: Transportation, energy, power get highest ADP shares in new budget

In order to facilitate this process, the central bank has provided guidance to the general public. They are advised to deposit their Rs 2000 banknotes, which were introduced subsequent to the demonetisation exercise six years ago, into their respective bank accounts. Additionally, individuals may also choose to exchange these notes for banknotes of other denominations at any bank branch.

All about Rs 2000 note

The introduction of the Rs 2000 note in November 2016, as per Section 24(1) of The RBI Act, 1934, aimed to meet the urgent currency requirements of the economy after the withdrawal of legal tender status from Rs 500 and Rs 1000 notes. Printing of Rs 2000 notes ceased in 2018-19 once an adequate supply of notes in other denominations became available.

The majority of Rs 2000 denomination notes were issued before March 2017 and have now reached the end of their estimated lifespan of 4-5 years. Considering that this denomination is no longer widely used in transactions and sufficient quantities of other banknotes are available, the Reserve Bank of India (RBI) has decided to withdraw the Rs 2000 denomination banknotes from circulation in line with its ‘Clean Note Policy’.

The Clean Note Policy is designed to provide the public with high-quality currency notes and coins featuring enhanced security features while removing soiled notes from circulation. The RBI previously decided to withdraw banknotes issued prior to 2005 due to their fewer security features compared to those printed after 2005. However, the pre-2005 notes remain legal tender but have been withdrawn from circulation to align with the international practice of having a single series of notes in circulation at any given time.

The current value of Rs 2000 notes in circulation

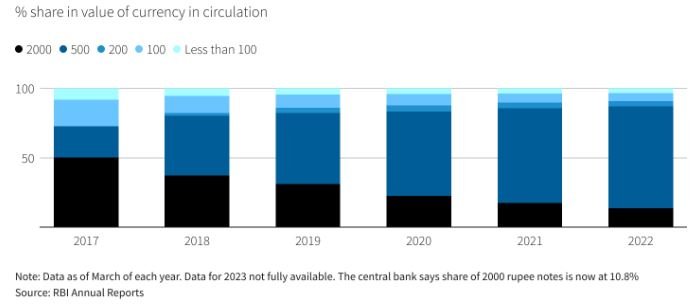

Around 89% of the Rs 2000 denomination banknotes currently in circulation were issued prior to March 2017 and have now exceeded their estimated lifespan of 4-5 years. The total value of these banknotes in circulation has declined from its highest point of Rs 6.73 lakh crore as of March 31, 2018, accounting for 37.3% of the total notes in circulation, to Rs 3.62 lakh crore, which represents only 10.8% of the notes in circulation as of March 31, 2023.

The RBI has instructed all banks to discontinue the issuance of Rs 2000 denomination banknotes immediately and reconfigure ATMs and cash recyclers accordingly. Banks with currency chests should prohibit withdrawals of Rs 2000 notes from the chests. All the balances held in the currency chests are instructed to be categorized as unsuitable and made ready for transfer to the corresponding RBI offices.

Legal tender status

Despite the withdrawal, the RBI has confirmed that the Rs 2000 banknote will retain its legal tender status. Individuals can continue using these notes for transactions and accept them as payment. However, the RBI encourages the public to deposit and/or exchange their Rs 2000 banknotes on or before September 30, 2023.

After September 30, the RBI has not provided clarity on the status of the Rs 2000 notes. Until that date, the instructions from the RBI regarding these notes will remain in effect.

To manage the exchange and deposit process, the RBI advises individuals to approach bank branches for the deposit and/or exchange of the Rs 2000 banknotes. This facility will be available at all banks until September 30, 2023. Additionally, exchange services will be provided until September 30 at 19 RBI Regional Offices with Issue Departments.

There are certain limits in place for exchanging or depositing the Rs 2000 notes. Individuals can exchange up to Rs 20,000 worth of Rs 2000 banknotes at one time, even if they don’t have an account at that bank. Account holders can also exchange Rs 2000 banknotes up to Rs 20,000 at a time through business correspondents, with a daily limit of Rs 4000.

Deposits into bank accounts can be made without restrictions, subject to compliance with applicable Know Your Customer (KYC) norms and other statutory/regulatory requirements.

For the convenience of banks in making necessary arrangements, the RBI has requested individuals to approach bank branches or RBI Regional Offices from May 23 onwards to exchange their Rs 2000 notes.

If an individual holds a substantial amount of Rs 2000 notes, they can technically seek multiple exchanges in packets of Rs 20,000 at a time. However, this may attract the attention of enforcement agencies and the Income-tax Department. Those with significant sums of money in Rs 2000 notes may encounter difficulties in exchanging their funds.

It is unlikely that bank branches will witness chaos and long queues similar to those seen in 2016. Unlike the widespread use of Rs 500 and Rs 1000 notes back then, Rs 2000 notes are no longer commonly circulated. Additionally, the decision to withdraw Rs 2000 notes was announced in advance, providing sufficient time for banks and the public to prepare.

Impact of withdrawals on overall economy

The withdrawal is not expected to significantly impact the market and economy due to the already limited circulation of the currency. The country’s strong digital payment system further mitigates any potential impact. The deposit or exchange of Rs 2000 notes by September 30 is likely to result in increased bank deposits. This development can alleviate the pressure for deposit rate hikes and positively impact banking system liquidity. The return of all Rs 2000 notes to the banking system will reduce cash circulation, further enhancing banking system liquidity.

According to Finance Secretary T V Somanathan, these notes are not widely used for transactions anymore, as digital payment systems have gained prominence. The high-denomination note was introduced for quick circulation after the 2016 demonetisation and has served its purpose.

Senior Congress leader P Chidambaram also mentioned that the Rs 2000 note is not a popular medium of exchange and its withdrawal was expected. However, he expressed the possibility of the reintroduction of the Rs 1000 note. Economists have stated that the withdrawal will not cause major disruptions as smaller denomination notes are available in sufficient quantities.

While some inconvenience may be experienced by small businesses and cash-oriented sectors such as agriculture and construction in the short term, the overall market and economy are expected to remain unaffected. The circulation of currency is already low, and the country’s digital payment system is strong.

As per a Reuters report, the improved liquidity in the banking system and the inflow of deposits into banks may lead to a drop in short-term interest rates as these funds are invested in shorter-term government securities, according to Karthik Srinivasan, group head of financial sector ratings at ICRA Ltd.