Despite a dip in 2020 due to COVID-19’s impact on immigration levels, international remittances have been on the rise for the past two years. It primarily benefits low- and middle-income nations since they can reduce poverty, enhance nutrition, and boost school enrollment rates, all of which support the SDGs and GDP growth.

YOU CAN ALSO READ: US BANKING CRISIS: HOW IS POST-2008 POLICIES IMPAIRING NOW?

Remittances have historically been an important indicator of a country’s economic strength. With the ability to reveal the relationships between citizens and their countrymen, remittances are an excellent indicator of the economic health of a nation and its GDP.

What is remittance?

Remittances are funds sent by migrants back to their native country. They are the private savings of employees and their families that are spent in the home country on food, clothing, and other goods and services, thereby driving the domestic economy and GDP. For many developing countries, remittances from citizens working abroad are an essential source of desperately needed funds. In certain cases, remittances surpass aid from the developed world and exceed only by foreign direct investment. (FDI).

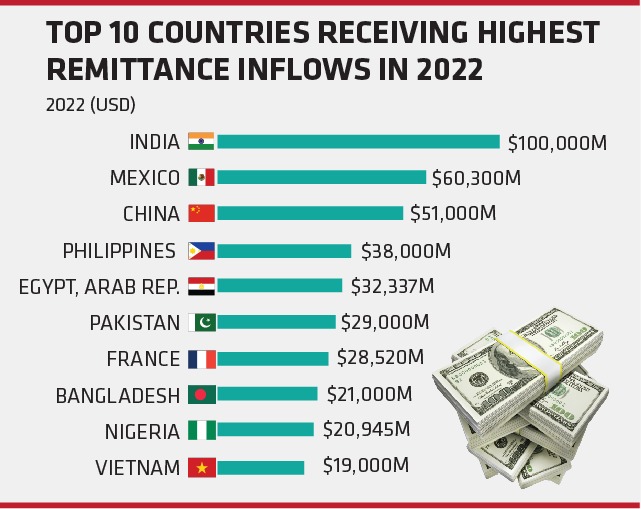

The top ten countries with highest remittance flows

For 25 low- and middle-income nations, remittances account for more than 15% of GDP. Let’s examine the top 10 remittance-receiving nations in terms of their remittance inflow.

India

With an estimated $100 billion in remittances obtained, India is said to have reached an all-time high in 2022. India has been topping the list of the largest recipients of remittances for the past 15 years. In 2021, India received approximately $89.4 billion in remittances, making it the world’s largest recipient. The number also represented a considerable 4.6% increase over previous years’ remittance inflows. This increasing flow of remittances can be partially attributed to migrant Indians transferring from low-skilled and low-paying jobs in Gulf countries to high-skilled jobs in high-income countries, such as the United States, the United Kingdom, and Singapore.

Mexico

Mexico is the second highest country in remittance receiving with around $60 billion transfers in 2022. It is also one of the world’s greatest economies and the United States’ largest trading partner. Mexico received an estimated $54.1 billion in remittances in 2021, making it another massive year for remittances in the country. Intriguingly, a substantial component of these funds originated in the United States, with increased integration and migration aiding in the acceleration of capital flows.

China

China rounds out the top three remittance-receiving nations, with an estimated $51 billion in inbound transfers in 2022. China is the world’s most populous nation and has one of the largest migrant populations. With the majority of its population being young and technologically savvy, it is simple to understand why remittances to China are on the rise, reaching $53 billion in 2021.

Philippines

With $38 billion in remittances or cash flows from Overseas Filipino Workers (OFWs) in 2022, remittances have considerably improved this country’s economy. In 2021, Filipinos remitted a record $36.7 billion to the country, a 5.2% increase from the previous year. Again, the majority of these remittances come from the United States.

Egypt

Egypt has received approximately $32 in remittances from migrants in 2022. In spite of the government’s best efforts to expand the economy, destitution and unemployment have increased among Egyptians in recent years. This appears to be why remittances are so important in the country. In 2021, the country received approximately $31.5 billion in remittances, the majority of which were in local currency.

Pakistan

One of the emerging economies in the Middle East, Pakistan is the seventh most populous country in the world and remittance transfer accounts for $29 billion in 2022. These inflows are dominated by remittances from Gulf countries. In 2021, however, remittances totaled approximately $31.2 billion, which was greater than in 2022.

France

With $28.5 billion in remittances, France ranks seventh in terms of remittance inflow in 2022. In contrast, the country received a total of $3.7 billion in digital remittances in 2022, with this figure anticipated to reach $5.17 billion in 2027. In 2021, France received $26.3 billion in remittances.

Bangladesh

Bangladesh is the eighth largest recipient of remittances from expatriates, receiving $21 billion in 2022. The country had received $22.2 billion in remittances in 2021. In 2020, remittances to Bangladesh accounted for an impressive 6.7% of the country’s GDP. The majority of remittances originate from the United States, the United Kingdom, and countries in the Middle East.

Nigeria

Africa’s largest economy, it comes as no surprise that Nigeria ranks on this list with $20 billion remittance. Nigeria has been afflicted by significant economic difficulties, predominantly due to political and social instability, which has led to a large number of migrations and an increase in remittances totaling $19.1 billion in 2021.

Vietnam

The nation has rose in the top 10’s lists this year with $19 billion transfers in 2022. In 2022, Vietnam’s remittances increased by 5.5% from the $18 billion recorded in 2021.

The impact of remittance flow on economies

Remittances contribute to the global economy, particularly in low- and middle-income countries. (LMICs). In 2022, despite adverse global circumstances, remittances to low- and middle-income countries (LMICs) have increased by 5% to $626 billion, World Bank reports. Every two months, migrant workers send home an average of $200 to $300. This money can account for approximately sixty percent of household income, constituting a significant financial lifeline for millions of families around the world.

In these nations, they have been shown to alleviate poverty, enhance nutrition, and increase attendance rates. Over fifty percent of all remittances are sent to rural households, where an estimated 75 percent of the world’s impoverished and food-insecure people reside. In addition, research indicates that these income flows can help recipient households become more resilient, particularly in the face of natural disasters. Furthermore, over 70 nations rely on remittances to fund at least 4% of their gross domestic product. (GDP). These nations demonstrate that remittances can contribute to socioeconomic development and change.

The COVID-19 pandemic slowed global immigration by 27 percent. In addition, travel restrictions, employment losses, and rising health concerns prevented many migrant workers from sending remittances to their families in their home countries. In 2020, the global amount of remittances received by countries decreased by 1.5% to $711 billion. Over the subsequent two years, however, the situation rapidly improved.

As visa approvals resumed and international borders reopened, global migration and remittance flows increased. The International Fund for Agricultural Development (IFAD) reported in June 2022 that remittances to low- and middle-income nations increased by 8.6% in 2021 alone. By 2030, the volume of global remittances is projected to reach $5,4 trillion, according to the agency.

According to Statista, global digital remittances totaled $117 billion in 2022; this figure is projected to reach $171 billion by 2027 and surpass $200 billion by the end of the next decade.

However, it is important to note that these transfers are not a solution for recipient nations. In fact, research indicates that an excessive reliance on remittances can lead to a vicious cycle that does not result in consistent economic development over time.

While remittances are a vital lifeline for many developing nations, they can also cultivate a dependence on capital flows from abroad, rather than encouraging the development of sustainable local economies. The greater a country’s dependence on remittances, the greater its dependence on the global economy remaining robust.

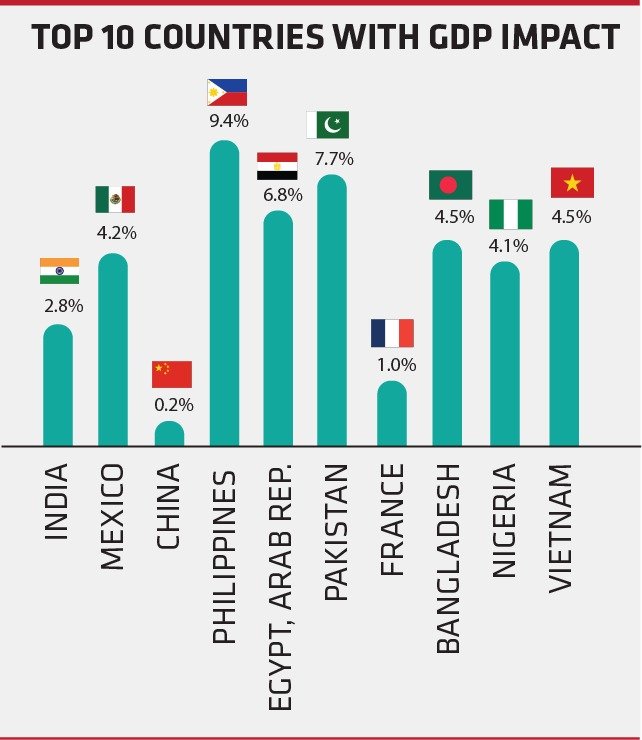

The impact on GDP

Although, remittance sent might be huge in numbers, the impact on GDP can be smaller. One thing we need to keep in mind is, GDP might be the most common way but is not the only indicator of economic growth. It also means the poverty alleviation rate, improved goods and services, wellbeing and improved living standard.

The above data shows that, despite India being the top remittance receiver, the GDP impact was 2.8% only. Whereas, Philippines was 4th in remittance inflow, while the GDP impact by remittance was 9.4%.

Lastly, remittance play an essential role in the global economy and contribute to domestic and international growth. With policies to protect and assist migrant workers and proper framework, remittance may support the development of the nation in a greater way.