The Indian business world has been marked by the meteoric rise and sudden downfall of many moguls, including businessperson Gautam Adani, whose empire fell dramatically after accusations of fraud and stock manipulation by the United States short-seller Hindenburg Research. The rise and fall of Indian tycoons is nothing new, and the story of other successful and fallen conglomerates, including Vijay Mallya, Anil Ambani, and Subrata Roy, shows the risks that come with great success, such as debts, lawsuits, and loss of reputation. SM TANJIL UL HAQUE writes things in detail

With the second largest population in the world, India has long been known as a land of opportunity where the entrepreneurial spirit runs deep and the potential for financial success seems limitless. However, with great wealth often comes great scrutiny, and as the years have passed by, many of these once-great tycoons have fallen from the grace. In a recent turn of events, India’s richest person, who was also the richest in Asia, Gautam Adani fell from the peak of great fortune. The recent saga involving Adani, the billionaire behind the Adani Group, has sent shockwaves throughout India. Until recently, Adani’s business empire appeared to be invincible – thereby playing a crucial role in India’s modernisation efforts. However, things took a dramatic turn for the worse when the United States short-seller Hindenburg Research launched a fierce attack against the Group – accusing it of stock manipulation, accounting fraud, and other wrongdoings.

YOU CAN ALSO READ: HPM SHEIKH HASINA ENVISIONS FOOD SECURITY WITH “BOOST FOOD PRODUCTION, LEAVE NO LAND UNCULTIVATED”

As a result, Adani’s companies lost around half of their market value, forcing Adani himself to abandon a fully subscribed share sale. Adani’s fall is just one example of the many Indian business magnates who have risen and fallen over the years. This rise and fall of Indian tycoons is not a new phenomenon. From Vijay Mallya to Gautam Adani, there have been many larger-than-life figures, who have managed to cast public attention with their immense wealth and extravagant lifestyles, only to come crashing down in a flurry of scandal and controversy. A closer look is taken at the stories of these titans of Indian business – thereby exploring the factors that led to their rise as well as the missteps that led to their downfall. This journey through the world of Indian business examines the highs and lows of some of the country’s most iconic tycoons.

A ROLLER-COASTER RIDE: STORIES OF TRIUMPH & TRAGEDY

The rise and fall of Indian tycoons is a tale as old as time, and there are many names that have come to be associated with this phenomenon. The world of Indian business has seen its fair share of success stories and scandals over the years. India has a long history of producing successful business tycoons, but with great success often comes great risk. From Anil Ambani to Harshad Mehta, many Indian tycoons have captured the public’s attention with their wealth and power, only to come crashing down in a flurry of controversy. Over the years, several Indian business magnates have made headlines for their meteoric rise to the top, only to fall from grace just as quickly. Here are three such examples:

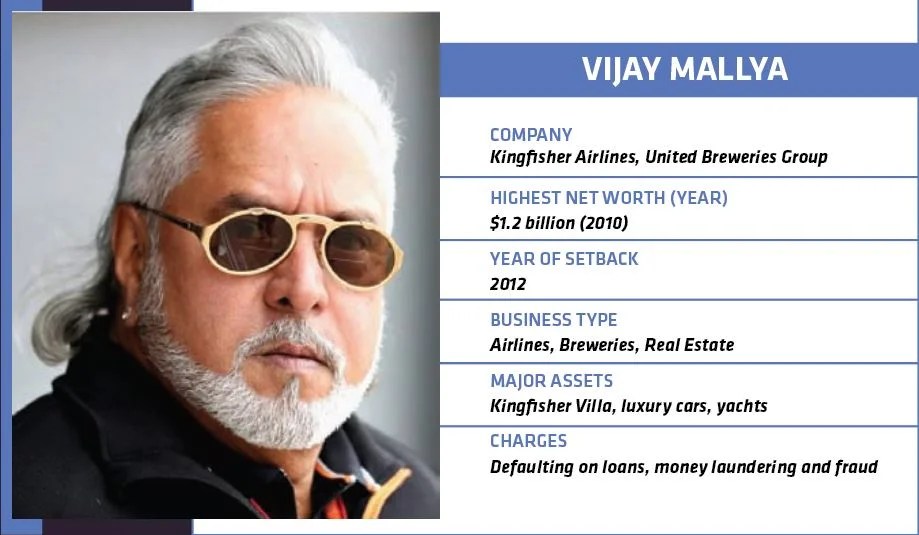

VIJAY MALLYA:

Once a king of the skies, Vijay Mallya was the founder and chairman of Kingfisher Airlines, which was once the secondlargest airline in India. Mallya also ran a number of other companies, including United Breweries Group, which produced some of India’s most popular beers. However, Mallya’s business empire began to crumble in 2012, when Kingfisher Airlines started to fall into debt. Mallya was later accused of defaulting on loans and money laundering, and he eventually fled to the United Kingdom in 2016 to avoid arrest, and in 2019, he was extradited to India to face charges. Despite his fall from grace, Vijay Mallya was once one of the richest men in India.

He was also known for his extravagant lifestyle, which included owning a fleet of luxury cars, a private jet, and a lavish mansion in the UK.

Mallya’s net worth was estimated to be around $1.5 billion in 2010, according to Forbes. However, his businesses began to accumulate debts, with Kingfisher Airlines alone owing over $1 billion to banks and other creditors.

In 2016, Mallya left India with debts of over $1.3 billion, and his extradition to India was sought by authorities.

As of 2021, Mallya’s debts have grown to over $1.8 billion, and his assets, including a luxury yacht, cars, and properties, have been seized or frozen by Indian authorities. Mallya’s case highlights the need for stricter financial regulations and the consequences of financial wrongdoing in India.

ANIL AMBANI:

Anil Ambani, the younger brother of Mukesh Ambani, once was the richest person in India, made a name for himself by building a business empire under the banner of Reliance Group. The conglomerate included companies in the telecom, power, and entertainment sectors. However, the group has faced a significant downturn due to high levels of debt, bad investments, and high-profile legal battles. In 2019, the group’s telecom arm, Reliance Communications, declared bankruptcy, contributing to the fall of Anil Ambani‘s business empire.

Anil Ambani’s net worth was estimated at $42 billion in 2008, according to Forbes. However, by 2020, his net worth had plummeted to around $70 million. The Reliance Group’s debt has been estimated to be around $14 billion, with a significant portion of it owed to various Indian banks. Anil Ambani’s legal troubles include a high-profile dispute with Ericsson over unpaid dues, which resulted in him being held in contempt of court in 2019. The group’s downfall has been a significant blow to Anil Ambani’s reputation as a business tycoon.

SUBRATA ROY:

Subrata Roy was the founder of Sahara India Pariwar, a conglomerate that included real estate, media, and finance companies. Sahara India Pariwar was one of India’s largest business groups, but Roy’s fortunes took a turn for the worse in 2014 when he was arrested for failing to refund billions of dollars to investors in a bond scheme. Roy spent two years in jail before being released on parole in 2016, and he is still fighting legal battles related to the case.

Subrata Roy‘s net worth was estimated to be around $1.2 billion in 2012, but he lost a significant amount of his wealth due to legal battles and financial troubles. As of 2021, his net worth is estimated to be around $1 million. In 2014, Sahara India Pariwar was ordered by the Indian Supreme Court to refund around $5.4 billion to investors who had bought bonds from the company. However, the company was only able to refund a fraction of that amount, and Roy was arrested for failing to comply with court orders.

THE LATEST GAUTAM ADANI SAGA

Now, turning to the Gautam Adani saga, the fallout from the Hindenburg Research report has raised serious questions about the Adani Group’s business practices and accounting methods. The group has denied all allegations of wrongdoing, but the damage has been done. Adani’s net worth has taken a hit, and some of his company’s projects are facing delays and cancellations due to the negative publicity

the ongoing crisis of the Adani group, in Mumbai, India on Feb 3, 2023.

HOW IMPORTANT IS THE ADANI GROUP FOR INDIA?

The Adani Group is a large conglomerate that operates in a variety of sectors, including ports, airports, roads, mines, and power plants. Its involvement in the development of India’s infrastructure has made it a central part of India’s modernization drive. Adani’s commitment to investing billions of dollars in green hydrogen production aligns with India’s goal of achieving net-zero carbon emissions by 2070. India’s government has also increased its capital investment outlay to 10 trillion rupees ($122 billion) in its last full budget before the 2024 general elections.

WHAT IS HINDENBURG’S ALLEGATIONS AGAINST THE CONGLOMERATE?

In its report, Hindenburg accused the Adani Group of stock manipulation, accounting fraud, high debt levels, and creating offshore shell entities to siphon money from listed companies. Hindenburg said that the group’s seven key listed companies had surged 819% on average in the past three years, adding about $100 billion to Adani’s net worth, even as they “have also taken on substantial debt, including pledging shares of their inflated stocks for loans, putting the entire group on precarious financial footing.” The Adani Group denied the allegations as “baseless,” calling the report “a calculated attack on India.”

WHAT HAS BEEN THE FALLOUT FROM THE SHORT-SELLER’S ATTACK?

Hindenburg’s allegations have had a profound impact on Adani Group stocks and bonds. By the end of Friday, the group had lost around half its $223 billion market value on Jan. 25. The share sell-off also affected Adani’s personal wealth, pushing him down to the 19th spot on the Forbes list of the world’s richest people. Lenders Credit Suisse and Citigroup have reportedly stopped accepting bonds from various Adani Group companies as collateral for margin loans. Additionally, S&P Global Ratings cut its ratings outlook on Adani Electricity and Adani Ports to negative from stable, and S&P Dow Jones Indices said it would remove Adani Enterprises from its sustainability indexes from next Tuesday.

WHAT HAPPENED TO THE $2.5 BILLION SECONDARY SHARE SALE?

Adani Enterprises, one of India’s largest companies, has cancelled its $2.5 billion secondary share sale, which was anticipated to be the country’s largest-ever follow-on public offering. The decision came after the Hindenburg report, which alleged that the Adani Group had links to offshore tax havens and raised concerns about its opaque business practices. Despite the sale being fully subscribed, with interest from foreign investors, corporates, and high net worth individuals, the group decided to abandon it as Adani Enterprises’ shares closed 30% lower than the offering’s floor price. The cancellation of the sale is a significant setback for the Adani Group, which had planned to use the proceeds to fund its ambitious growth plans.

WHAT’S NEXT FOR THE ADANI EMPIRE?

The Hindenburg report has sparked a clamour for investigation into the allegations by India’s political opposition, which for the second day in a row on Friday did not allow either house of parliament to function. That could make local financial institutions cautious about lending more money to the conglomerate. The group has built a global presence through ports it operates in Israel and Sri Lanka, along with coal mines in Australia and Indonesia. Hindenburg’s allegations make it imperative for the conglomerate to revamp its image to secure financing to maintain its scorching growth. Meanwhile, scrapping the secondary share sale has already dealt a blow to the group. It had planned to invest almost half the proceeds to fund green hydrogen projects, airports and expressways, while about 20% would have gone to repaying debt.

“This decision to scrap the share sale will not have any impact on our existing operations and future plans. We will continue to focus on timely execution and delivery of projects”

Gautam Adani

The Adani Group has maintained that it has strong cash flows and “an impeccable track record” of servicing debt, which research firm Jefferies estimates at 1.6 trillion rupees for the fiscal year ending March 2022. “This decision [to scrap the share sale] will not have any impact on our existing operations and future plans. We will continue to focus on timely execution and delivery of projects,” Adani said in a statement. “Once the market stabilizes, we will review our capital market strategy.” Adani Ports and Adani Transmission reportedly made coupon payments for U.S. dollar-denominated bonds as scheduled on Thursday. The Reserve Bank of India on Friday said the country’s banking system remains resilient and stable.

INDIA: A LAND OF OPPORTUNITY FOR BUSINESS

Despite the risks that come with great wealth and success, India remains a land of opportunity for entrepreneurs and investors alike. With a rapidly growing economy and a young, tech-savvy population, India offers endless potential for businesses across a range of sectors, from technology to renewable energy. The Indian government has also implemented various initiatives, such as Make in India, Digital India, and Startup India, to promote innovation and entrepreneurship, making it easier for businesses to set up and operate in India. While there are risks involved in doing business in India, the country’s potential for growth and development cannot be ignored. India’s recent rise as a major player in the global economy is a testament to the resilience and adaptability of its people, and it is clear that the country will continue to be a land of opportunity for businesses in the years to come.

In conclusion, the rise and fall of Indian tycoons is a cautionary tale of the risks that come with immense wealth and power. As the famous quote by Lord Acton goes, “Power tends to corrupt, and absolute power corrupts absolutely.” The stories of Gautam Adani, Vijay Mallya, Anil Ambani, and Subrata Roy, among others, serve as reminders that success and fortune are not immune to the consequences of unethical practices and financial wrongdoing. As India continues to produce successful business magnates, it is crucial that the country prioritises stricter financial regulations and accountability to prevent such instances from repeating in the future.